The number of design occupations decreased in 2009 due to a weak economy, but even with that drop the city still saw a 75 percent gain in the period from 2000 to 2009, an astronomical increase by any measure.

Although total employment closely tracked the broader city economy—there was a steady decrease after the tech bubble burst in 2001, a steep increase during the building boom, followed by a precipitous drop in 2008—the growth in the number of design firms in the city also showed surprising resilience, with a 19 percent gain between 2003 and 2008 and less than one percent loss thereafter.

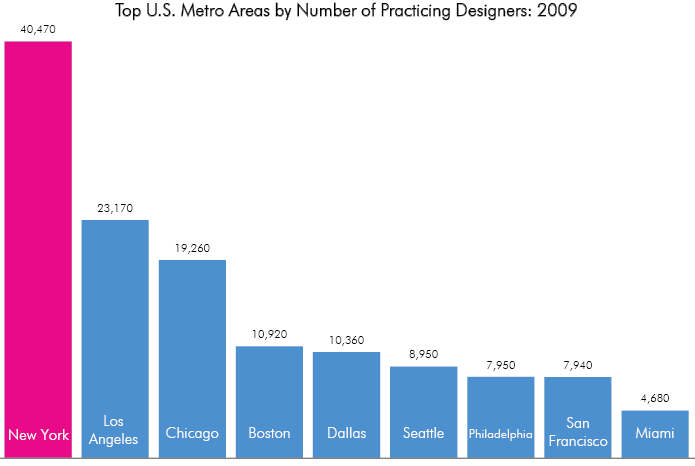

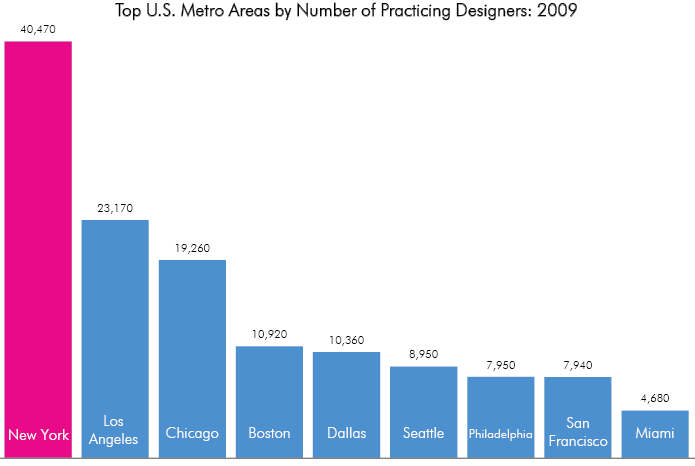

When the design industries begin to pick up steam again, there’s little doubt that New York will be at the center of the recovery. Simply put, no other place has the concentration of design jobs as New York. This is clear when examining New York City’s location quotient, which measures the relative strength of a region’s industry cluster compared to the nation. A location quotient of 1.00 shows that an industry makes up the same share of a local economy as it does of the national economy. High location quotients (for instance, Las Vegas has a high location quotient in the hospitality and entertainment sector) show that a local area has a much greater share of workers in a particular sector than the nation, indicating a competitive advantage. The data shows that the New York metro area has a particularly strong industry cluster in design.

When looking at all design fields, New York has a higher location quotient (1.92) than any other major metro area with the exception of San Francisco, which has an equivalent location quotient but a much smaller pool of designers. Boston (1.5) and Los Angeles (1.4) have the next highest location quotients. New York is also a clear leader in architecture and graphic design, but its greatest comparable advantage is in fashion design—the city’s location quotient in this field is 10.8, compared to 5.8 for Los Angeles and 2.3 for San Francisco.

The numbers suggest that New York design firms are not only serving clients locally, but nationally and internationally. This was confirmed in our interviews. Even furniture designers and interior designers, who rely to an uncommon degree on wealthy local clients, exported their services to other parts of the country—in the case of Brooklyn’s budding furniture design community, for instance, Southern California is an important and growing consumer market. Graphic designers who work at New York-based publishing houses and media companies are more often than not developing products meant for a national audience.

Increasingly, New York-based architects are finding the fastest growing markets for their services to be in Asia and the Middle East. Among New York’s top grossing architecture firms, more than a third of their almost $1 billion in revenue in 2009 came from overseas clients. New York-based Kohn Pedersen Fox (#22 on Architectural Record’s list of top firms by revenue), for example, designed the Shanghai World Financial Center, the tallest building in China, and is currently working on designs for a new airport for Tianjin—China’s fourth largest city—in addition to four skyscrapers in Marina Bay, Singapore. Rafael Viñoly (#24) is the principal designer behind three major new developments in Abu Dhabi, including the master plan for a New York University’s new campus there.

Pentagram, which is working in nearly a dozen countries, is just one of many New York-based graphic design firms that have experienced an increase in global projects. And a number of industrial design firms we spoke to said they were getting work from overseas manufacturers. For example, Smart Design, a large firm with 150 employees, recently completed hardware designs for a new laptop computer for Acer Inc., desktop organizational software for Toshiba, and a new MP3 player for a South Korean electronics company called iriver. Pensa, a comparatively tiny Brooklyn-based firm, has partnered with a variety of large multinational companies like Samsung and Pepsi to do consumer experience research and identify opportunities for product development and innovation.

Typically, overseas companies will look to New York-based designers for ideas and strategies on how to tap the U.S. market, but not always. New York’s pool of fashion design talent, for example, is unrivaled anywhere in the world, so it’s not uncommon for foreign companies to open studios here to capitalize on the city’s deep pool of talented designers even when they’re marketing to consumers on the other side of the globe. For example, according to Tim Marshall, provost of Parsons School of Design, a South Korean holding company called SK Networks recently opened a studio in Chelsea to produce fashion brands meant for Chinese consumers. “A fashion studio for the building of these Chinese brands,” marvels Marshall. “They didn’t have the talent there.”

New York isn’t the only city to have experienced significant growth in the design fields over the last decade, but in nearly every field New York’s growth outpaced the nation’s, in some cases by large measures. While it only has 3 percent of the nation’s total occupations, New York has 42 percent of its fashion designers, 8 percent of architects, 8 percent of graphic designers, and 6 percent of industrial designers.

Many of the experts we interviewed say there are good reasons for that dominance. New York has an unparalleled number of universities and museums that serve as important venues for the circulation and exchange of ideas, including Parsons School of Design, the School of the Visual Arts, the Fashion Institute of Technology, the Pratt Institute, the Museum of Modern Art, and the Smithsonian’s Cooper-Hewitt Museum, to name only a few of the most prominent. Moreover, the city’s deep pool of talent is a huge draw for design studios and other companies that employ designers, which leads not only to job opportunities but the chance to apprentice with established, cutting-edge firms. Also, a large congregation of creative talent supports a wide variety of specialized services that are important—and in some cases pivotal—to the design process. Fashion designers in the Garment District, for instance, will sometimes work with pattern makers to come up with designs that look and feel right on the fit models; architects will work with engineers to make use of new materials and create complicated surfaces; industrial designers will work with product photographers to create promotional materials; and so on. Other big cities offer similar services, but not many can offer the sheer number and variety that New York does.

While the design industries offer incredible promise for New York, the city’s future growth in this area is not guaranteed, especially since global competition will only increase in the years ahead. Yet, to a large extent, this part of the economy has floated under the radar of local economic development officials.

While the Bloomberg administration has admirably launched several new initiatives to support the city’s fashion industry, the city’s economic development agencies have not devoted any meaningful attention to other design industries. And the city has also done little to promote the city’s designers. Other cities like London and Milan go to great lengths to brand their products at both local and foreign trade shows. London’s nine-day long design festival is a huge event with over 350,000 visitors from all over the world; the city’s tourism agency promotes the event in other countries, and the UK Trade and Investment does significant outreach to foreign clients (see London’s Design Initiatives, page 27). Yet New York’s chief economic development agency (the New York City Economic Development Corporation) and the main tourism agency (NYC & Company) have only partnered to promote Fashion Week, leaving the city’s architects, interior designers, furniture designers and industrial designers to fend for themselves during their local trade shows.

A vast majority of the designers we interviewed thought New York was far too complacent about its status as a design hub. “New York has become a much friendlier place for design in the last decade,” says Vishaan Chakrabarti, an architect and former executive vice president at The Related Companies, a major New York City real estate development company. “But I still think we have a long way to go in terms of having a true design sensibility in this city. Cities like London and Tokyo have a far greater respect for design and each could make their own claim about being a design capital.”

As it is, there are clear obstacles to the continued strength of New York’s design sector. One is high real estate and living costs. Young designers, like young artists and writers, are fleeing to other creative hubs where studio and living spaces can be had for a fraction of the cost. Also, compared to Boston or Silicon Valley, New York has very little venture capital funding for design and technology teams developing new products in electronics and digital media. Industrial designers on the West Coast have started to play a much larger role at the beginning of the development process for new technologies, designers say. But, in New York, start-ups find it more difficult to connect with locally-based designers.

While some of the best opportunities for growth in New York’s design sector lie overseas, in fast-growing emerging markets, the city has no real export assistance strategy, and the state’s export promotion programs have focused almost exclusively on assisting manufacturers—not designers and architects, and other service providers.

In the years ahead, as consumer markets in Brazil, India, and China continue to heat up, New York’s cutting-edge design firms could prove to be a huge competitive advantage. But for New York to capitalize on this opportunity—and help diversify its economy—policymakers at the city, state, and even federal level will need to develop a strategic plan to harness New York’s one-of-a-kind design expertise, evaluate the potential of design as a growing service export, and connect firms with new clients abroad.

This is an excerpt. Click here to read the full report (PDF).