It was only about 15 years ago when the tech sector began its meteoric rise as a major new economic force in New York City. Although the city had a foundation of tech companies well before this point the period from 2007 to 2012 saw a remarkable wave of new start-ups, the development of a strong local ecosystem, and faster growth in venture funding than any other city or region.

Today, the city’s tech sector has not only continued its explosive growth and cemented its status as the nation’s second-largest tech hub, behind San Francisco. It has reached a new level of importance to New York’s economy, becoming the city’s most dependable economic engine and reliable source of new well-paying jobs.

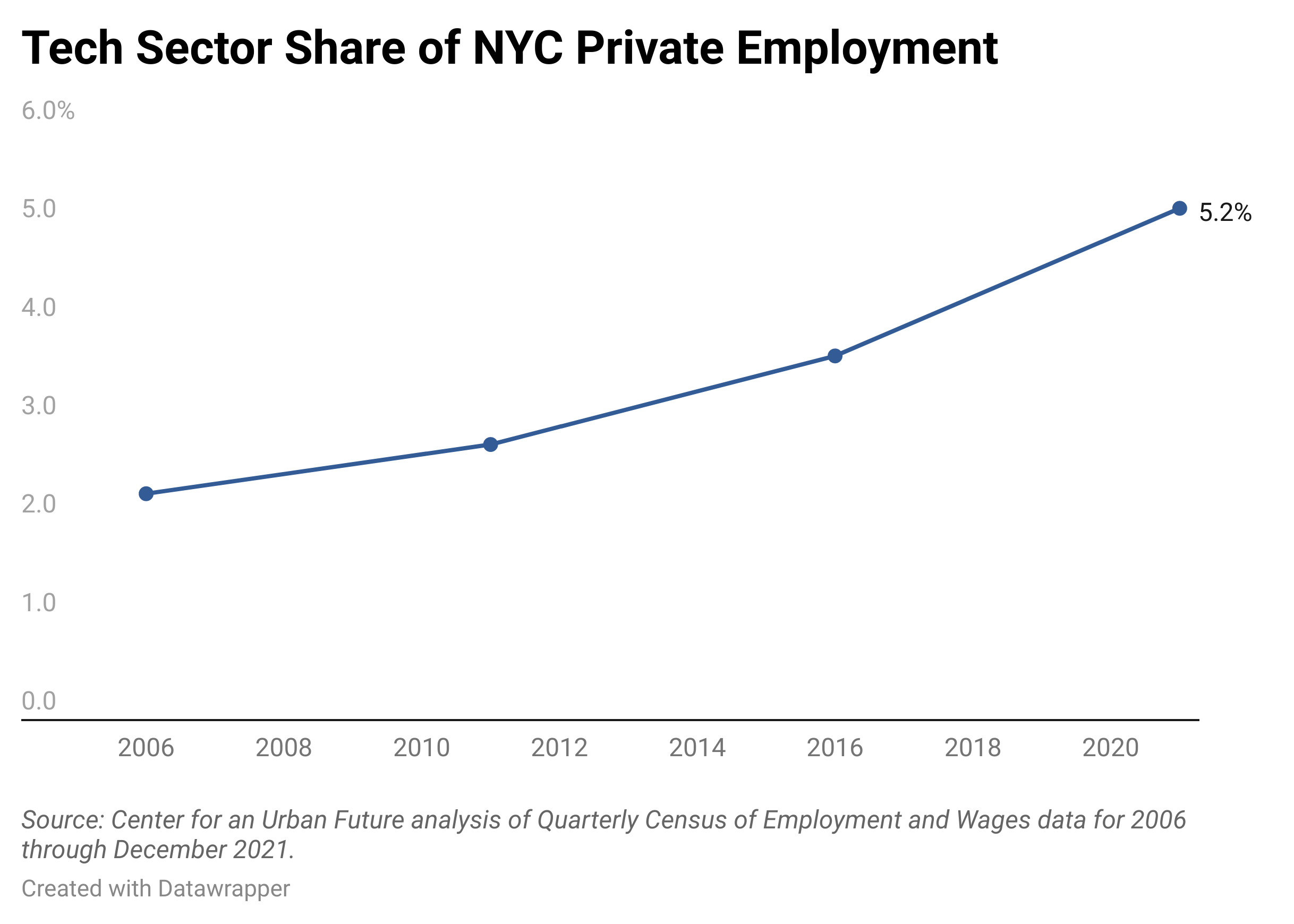

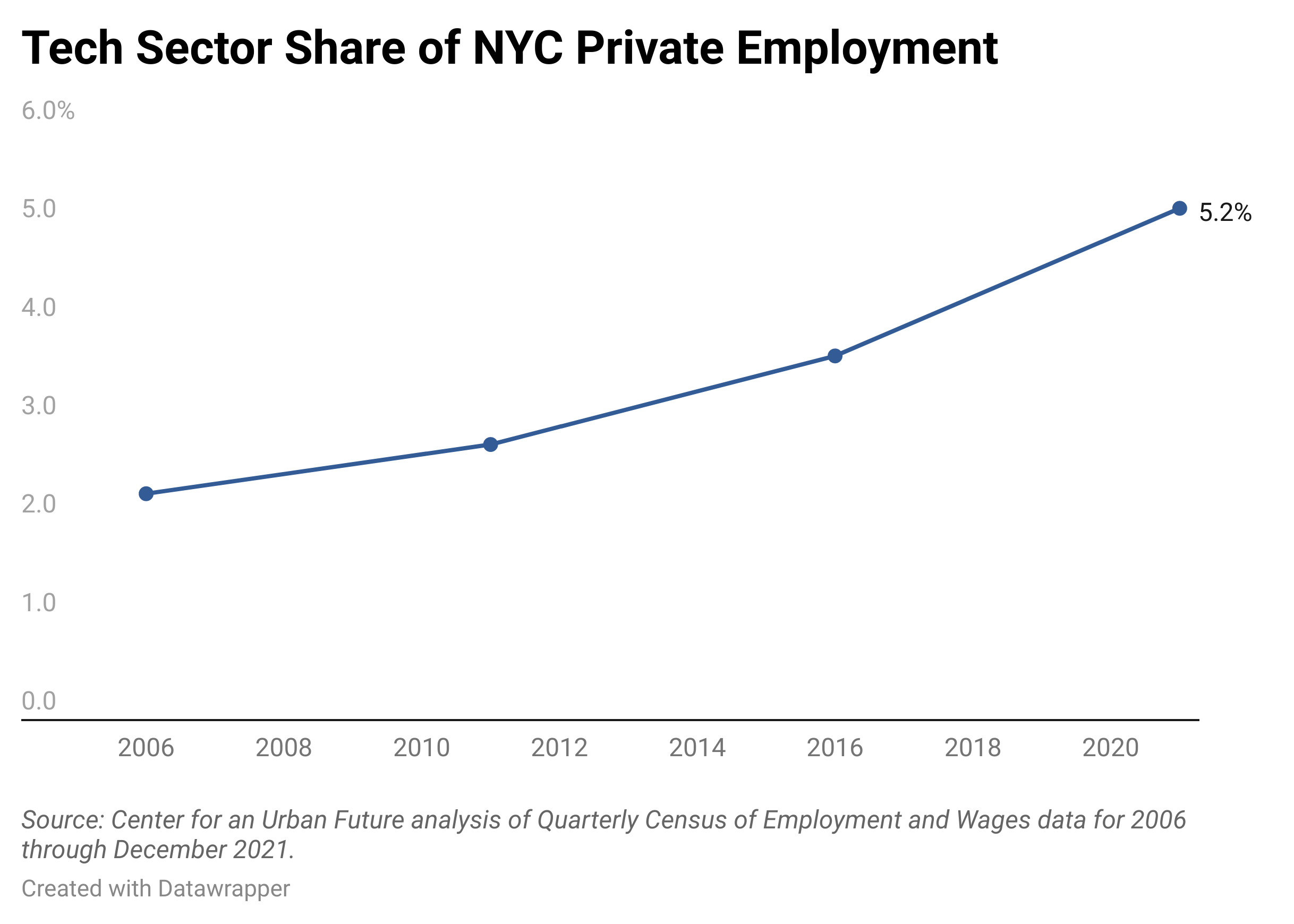

The tech sector now accounts for 5.2 percent of the city’s total private sector employment, double its share from 2010 (when it made up 2.6 percent).

Since 2010, the city’s tech sector added 114,000 jobs, a growth rate of 142 percent.1 Remarkably, the tech sector accounted for 17 percent of the city’s entire job growth during this period (114,000 out of 686,000 total jobs added).

During this period, employment in the tech sector grew more than seven times as fast as the city’s overall economy (which increased 19.1 percent). The tech sector also added jobs at a faster clip than nearly every other industry in the city’s economy, growing 17 times as fast as the city’s finance and insurance sector (which increased by 8.4 percent), nearly 5 times the rate of the advertising field (+29.7 percent); more than 3 times the rate of healthcare (+46.1 percent), and more than twice as fast as the film and TV sector (+60.8 percent). The tech sector was also one of the city’s fastest-growing sectors in both the decade prior to the pandemic and in the period since the onset of COVID-19.

At a time when New York City still has 173,000 fewer jobs than it did before the start of the pandemic, the tech sector will be crucial to igniting a long-term post-pandemic jobs recovery. New York is already well positioned in many of the emerging tech sub-industries poised for growth. Our detailed analysis of data from Crunchbase shows that the city has experienced start-up growth of at least 50 percent in ten different tech fields since 2016—from blockchain and real estate tech to women’s and family tech, artificial intelligence, and augmented reality.

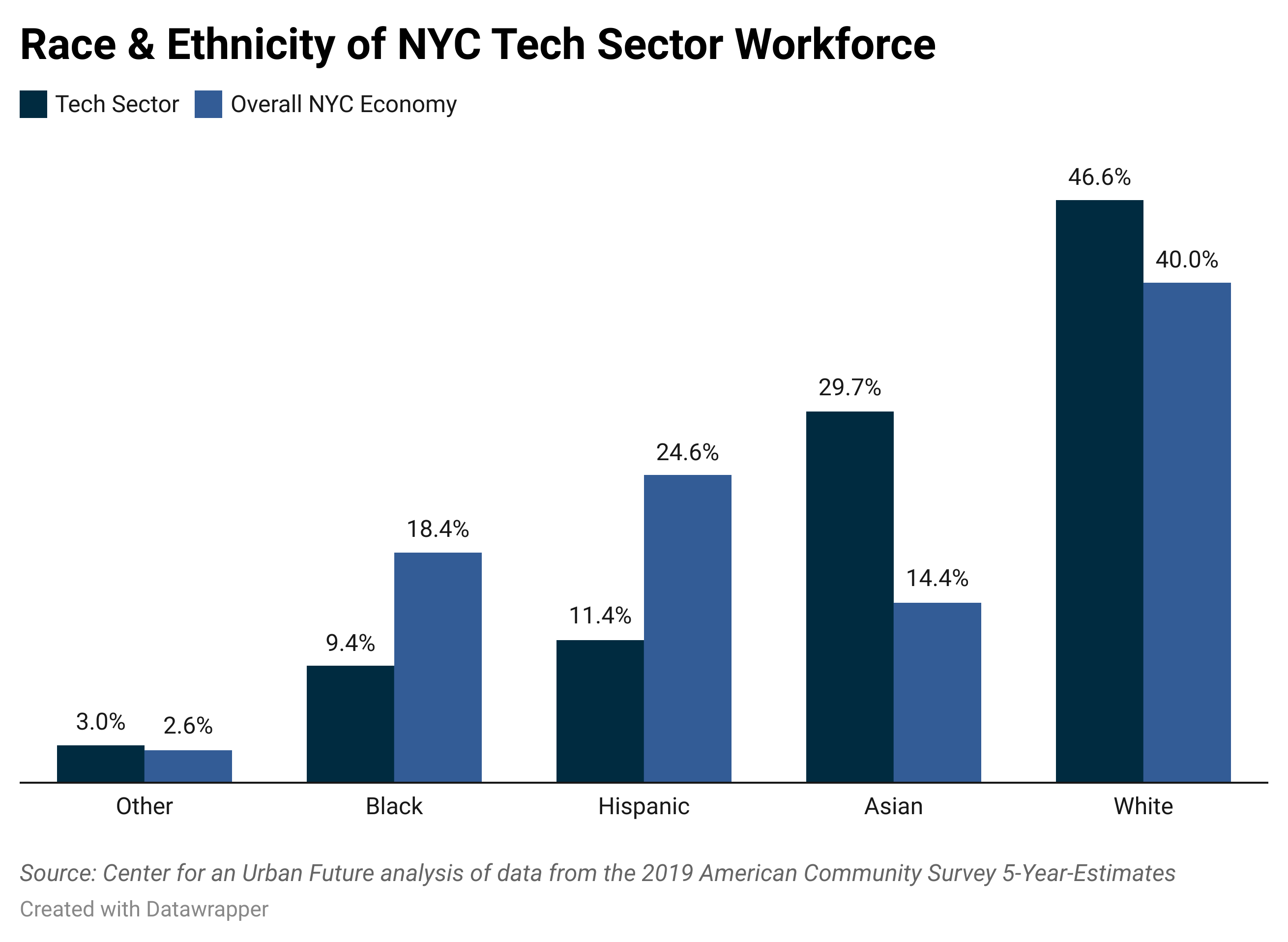

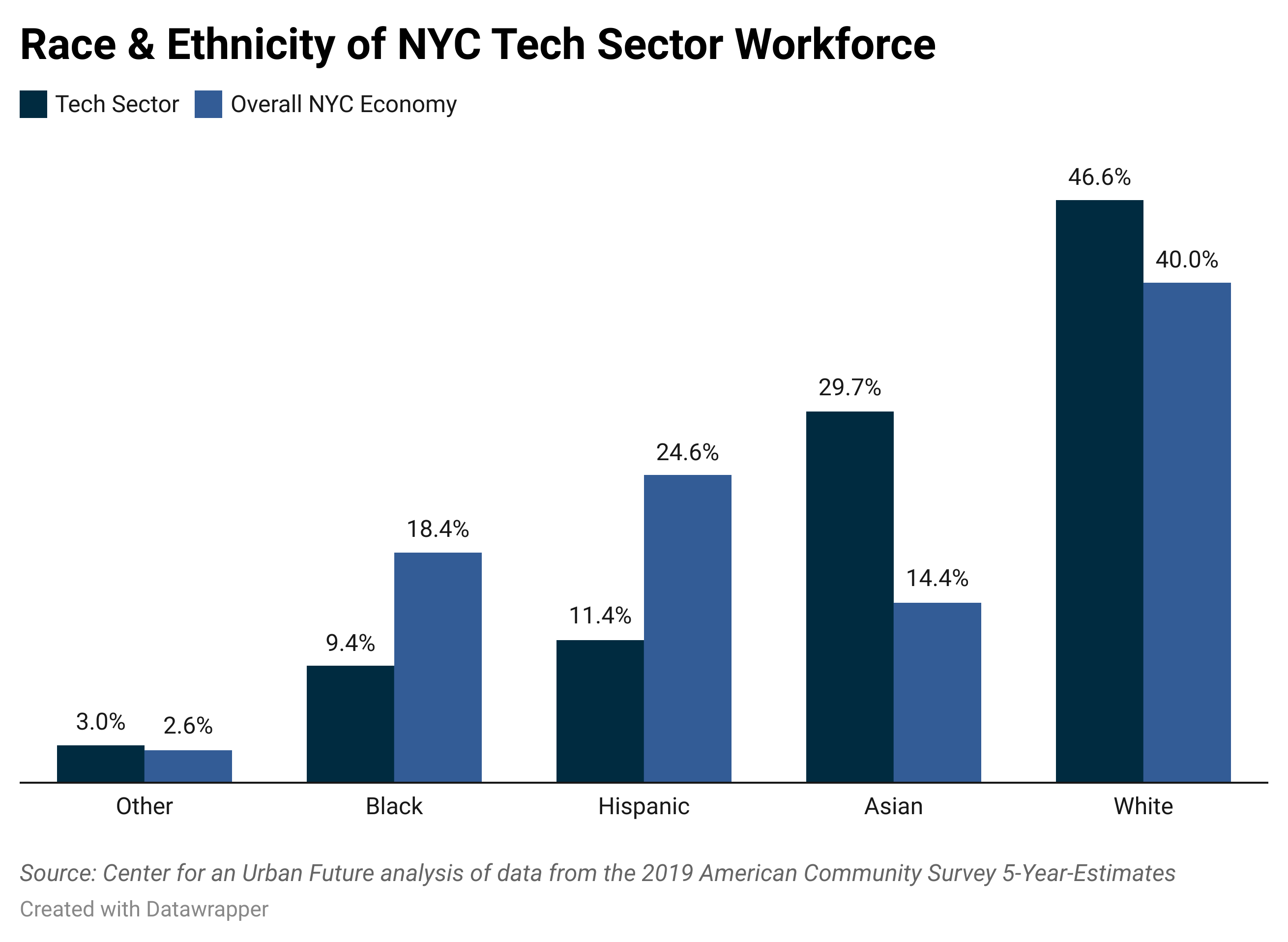

If New York succeeds in capturing a large share of the industry’s future growth, it can benefit a diverse mix of New Yorkers. Black and Hispanic New Yorkers already make up 20.8 percent of New York’s tech sector workforce, compared to 8.5 percent in the San Francisco Bay Area and 9.7 percent in the Boston/Cambridge area.2 This level of representation is still far from where the sector should be in reflecting the diversity of New York’s population, and this report includes several recommendations for significantly expanding access to tech careers. However, our research also reveals that more private and public efforts are underway than ever before to diversify tech employment in New York and build stronger pathways into well-paying tech jobs.

Despite this enormous potential, the tech sector’s long-term sustainable growth in New York is by no means assured. While industry leaders and start-up founders interviewed for this report were almost uniformly bullish on the city, several still-evolving economic trends could dampen New York’s growth. Chief among them is the rise of remote work, which has made it easier than ever for tech workers—and the companies that employ them— to locate elsewhere.3 Moreover, this trend is happening while Miami, Austin, Nashville, and several other cities that offer comparatively affordable real estate—and budding tech ecosystems of their own—are making plays to poach companies and talent from the five boroughs. The departure of several tech companies from San Francisco since the pandemic arrived is a cautionary tale for what could happen here, as unlikely as many New York–based tech leaders believe that to be.4

New York can overcome these and other challenges to build a larger, more sustainable, and more inclusive tech ecosystem. But it is unlikely to happen without renewed support from city leaders.

Researched and written by the Center for an Urban Future (CUF) in partnership with Tech:NYC, this report examines the emergence of New York’s tech sector over the past decade into one of the two or three most important parts of the city’s economy; details the core strengths and emerging competitive advantages of the city’s start-up ecosystem in recent years; analyzes which tech subsectors in New York offer the most potential for future growth; and identifies critical challenges that city leaders will need to address in order to ensure the sector’s long-term growth.

The report is a ten-year update of CUF’s landmark 2012 study, New Tech City, which provided the first comprehensive analysis of the tech sector’s rise in New York. It draws from an extensive analysis of public and private data on tech start-ups, industry employment, and venture capital (VC) funding, and from interviews with more than 50 start-up founders and tech industry leaders, venture capitalists and investors, economic development experts, civic technologists, incubator and accelerator leaders, and other experts from across the city’s tech ecosystem and around the country. The report concludes with a set of practical recommendations for policymakers and business leaders to ensure the continued sustainable growth of this sector and maximize the benefits for all New Yorkers.

The New Engine of NYC’s Economy— and New Driver of Good Jobs

Tech isn’t yet New York City’s largest industry. With 575,000 jobs in the city, healthcare has far more jobs than any other part of the economy. But tech has become New York City’s new engine of job growth.

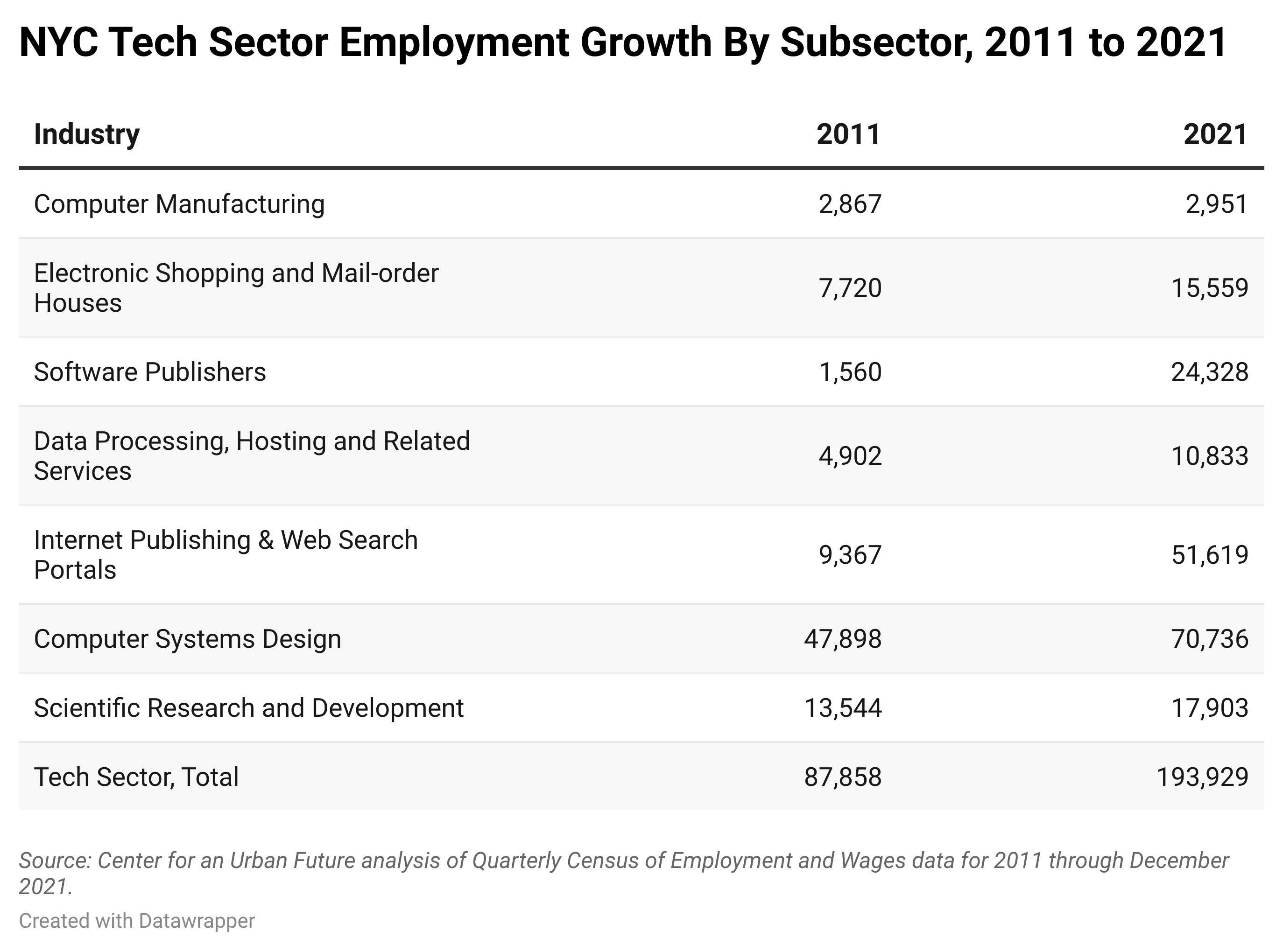

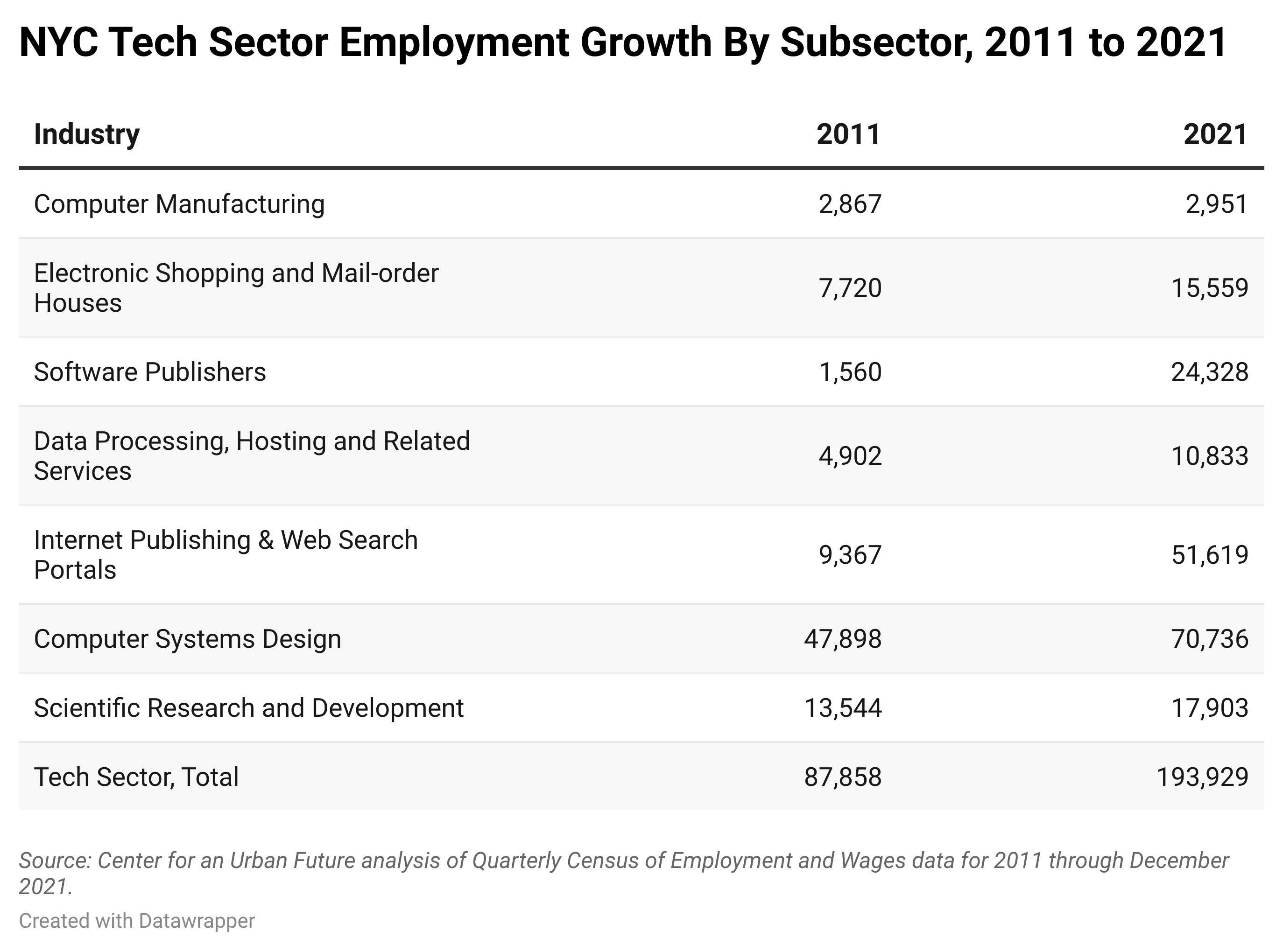

The city’s tech sector added 114,000 jobs since 2010—going from 80,020 jobs in 2010 to 193,929 in December 2021.5 And our analysis almost certainly undercounts the true size of tech employment in New York, since this report uses the Federal Reserve Bank of New York’s narrow definition for measuring employment in the tech sector—one that doesn’t include tens of thousands of additional tech workers employed at banks, hospitals, and in other non-tech industries.6 (Other analyses have found that when all of these other technology jobs are included, the city’s tech ecosystem employs 372,000 people.)

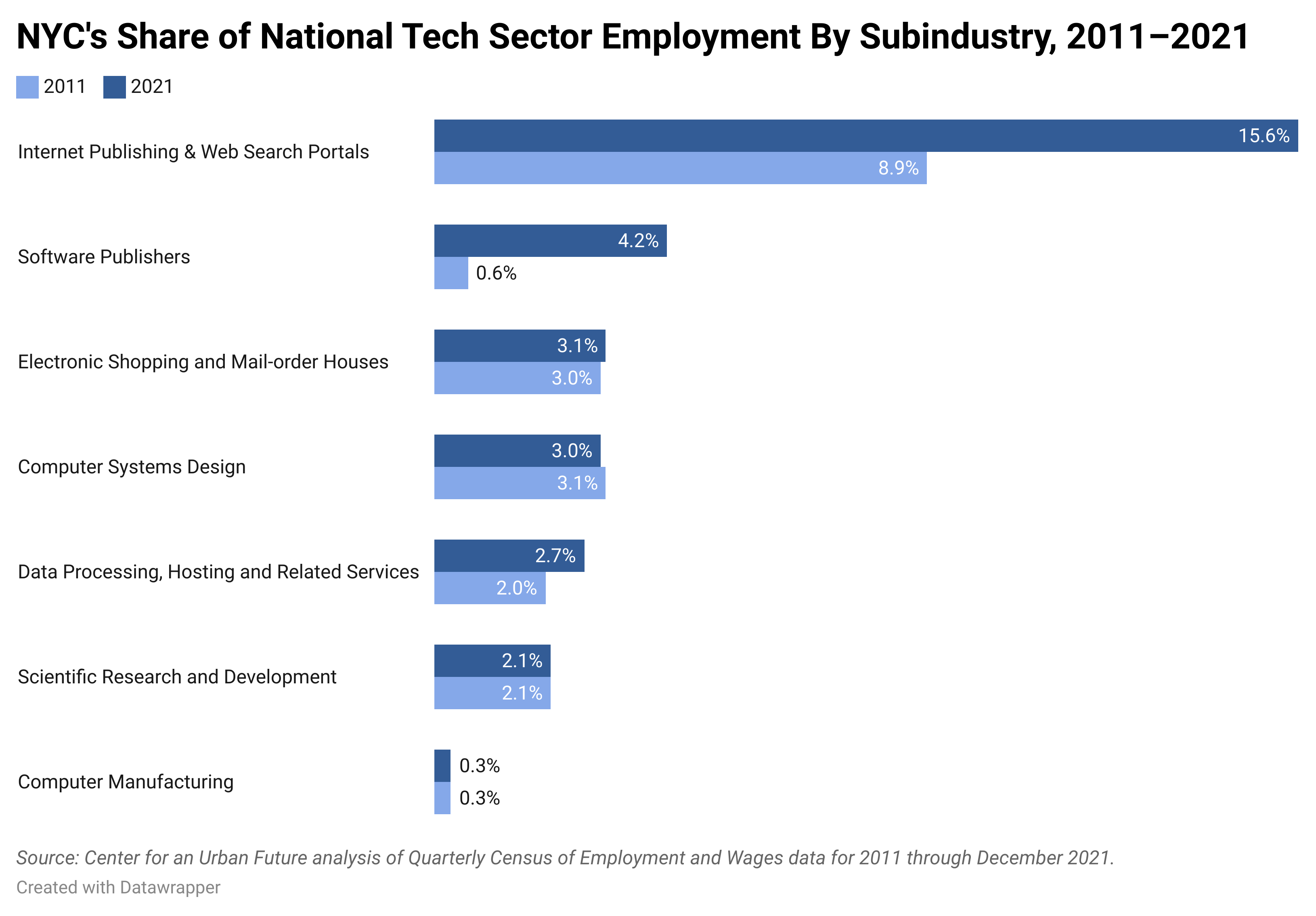

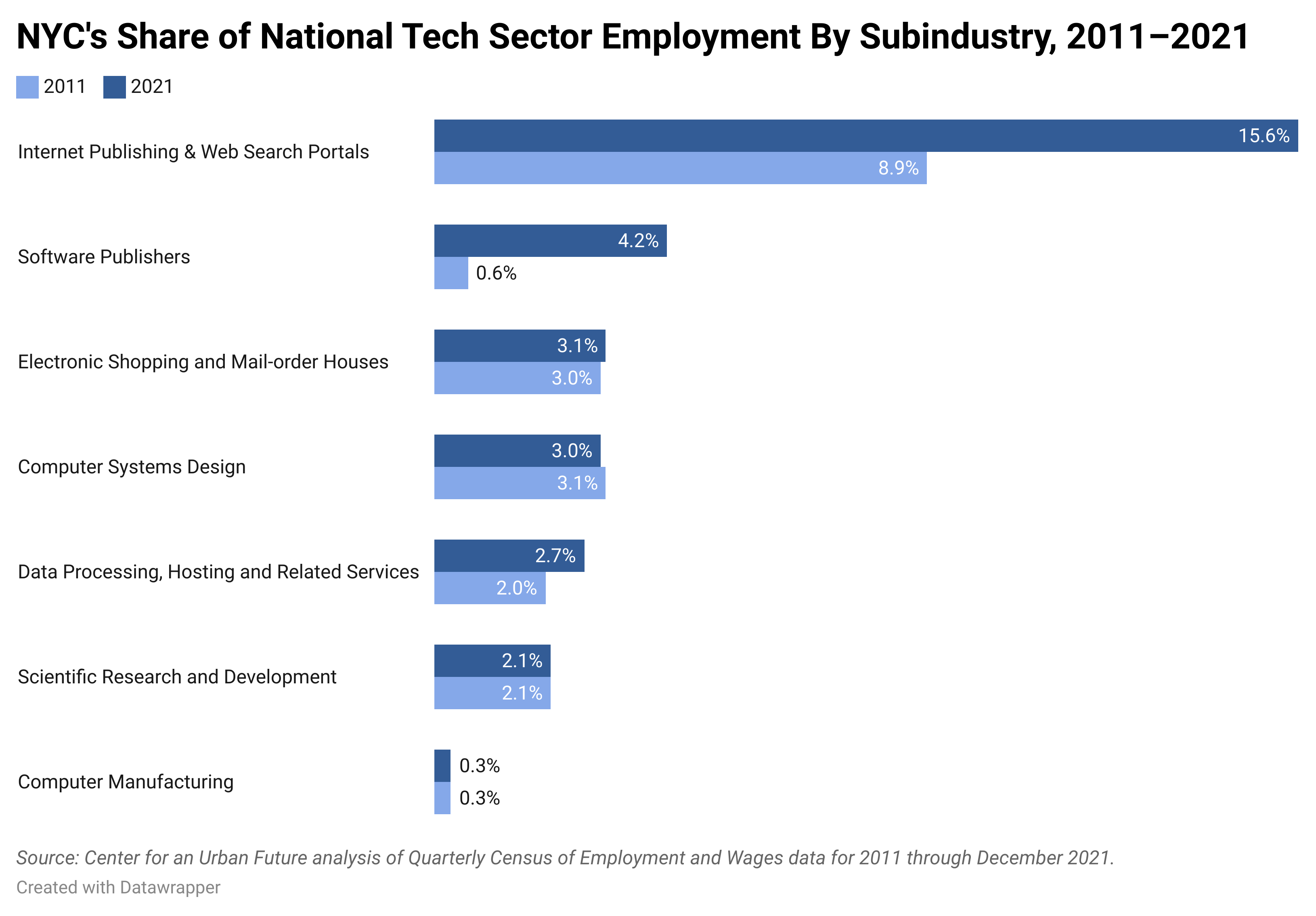

While the tech sector overall grew by 142 percent during this period, the slice of the industry focused on web content and services (“Internet publishing and web search portals”) grew by a whopping 567 percent—increasing by nearly 44,000 jobs, from 7,737 positions in 2010 to 51,619 in December 2021. The “software publishing” sub-sector, which includes companies developing applications and computer software, saw even more meteoric growth, going from 1,586 jobs in 2010 to 24,328 at the end of 2021, an increase of 22,742 jobs (or 1,434 percent).

.png)

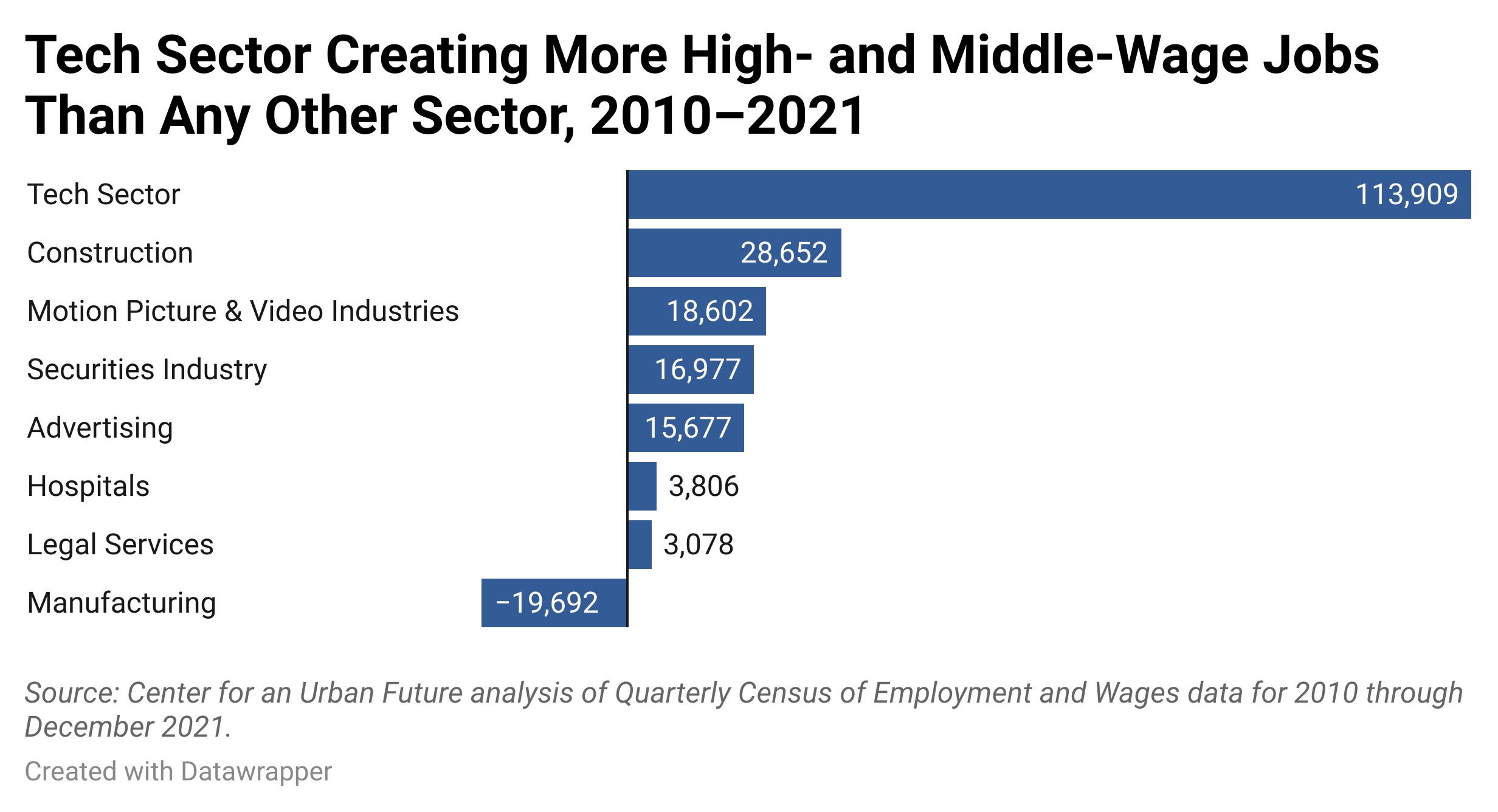

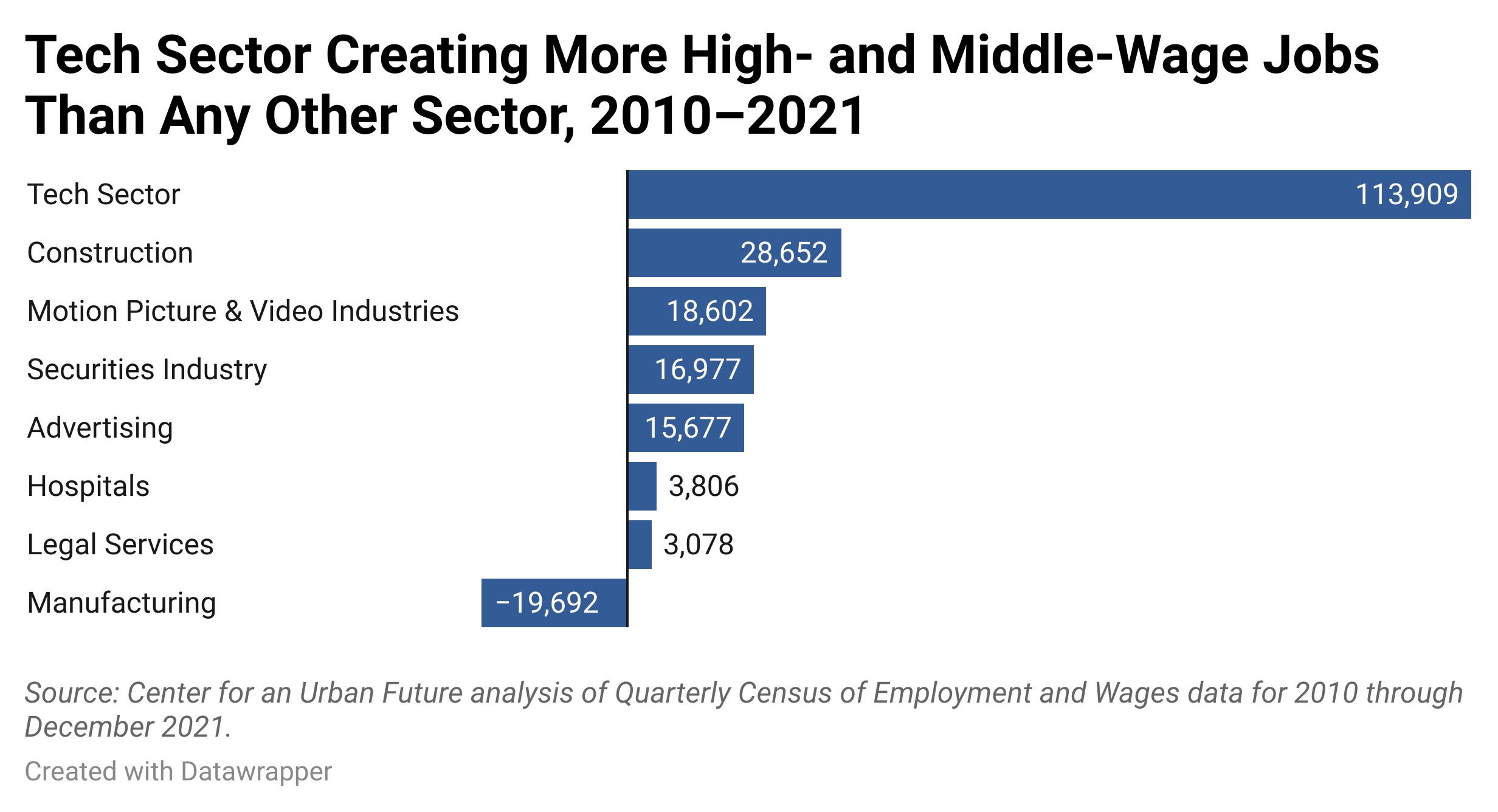

In addition to raw job growth, the tech sector has also become the city’s most reliable source of new middle- and high-wage jobs—an important development across a decade in which New York City added more jobs paying less than $50,000 annually than those paying more than $80,000 annually. While the tech sector added 114,000 mostly well-paying jobs since 2010, other industries that had been among the most dependable creators of good jobs in previous decades produced much less growth. For example, during this same period, hospitals added 3,800 new jobs; the construction industry registered a net gain of 28,600 jobs; the securities industry added 17,000 jobs; law firms added 3,000 jobs; and manufacturing actually shed 19,700 jobs.

Our analysis of data from the New York State Department of Labor shows that tech sub-industries accounted for a disproportionate share of the fastest growing industries in the city over the past decade— and nearly all the fast-growing industries that pay at least $80,000 annually. In fact, four of the ten fastest growing sub-industries were in tech. And of the five fastest-growing fields that pay average wages of at least $80,000, four are in tech. (Among the six industries in which employment more than doubled during this time, three pay more than $80,000 annually—and all three are in tech. Of the other three fastest-growing industries, home health care services pays average wages of just $30,800, warehousing & storage has average wages of $37,800, and the employment services sector pays $69,500.)

The tech sector has also been among the city’s few economic bright spots during the pandemic. Between February of 2020, the month before the pandemic, and September 2021, private sector employment in the city declined by 9.8 percent and most major industries suffered declines, including healthcare (which had a 3.1 percent decline in jobs), finance (-3.5 percent), and retail (-14.3 percent). During the same period, jobs in the city’s tech sector increased by 1.5 percent.

Some tech sub-industries barely slowed down during the pandemic, with employment in the “software publishers” industry growing by 8.7 percent between February 2020 and September 2021 and the “Internet publishing and web search portals” field growing by 8 percent. In May 2022, there were a staggering 1,338 open jobs at Google that offered the New York campus as a work location.

A Much Larger and More Sustainable Tech Ecosystem

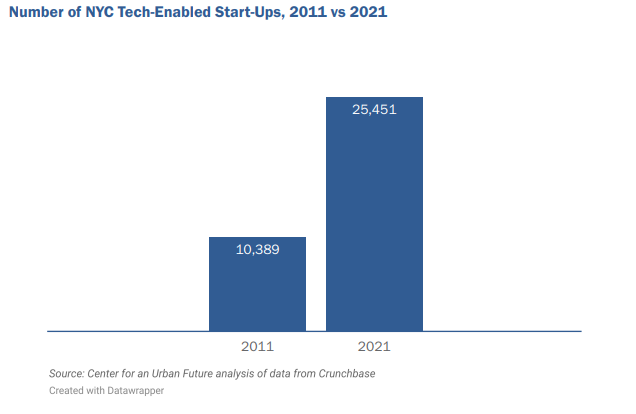

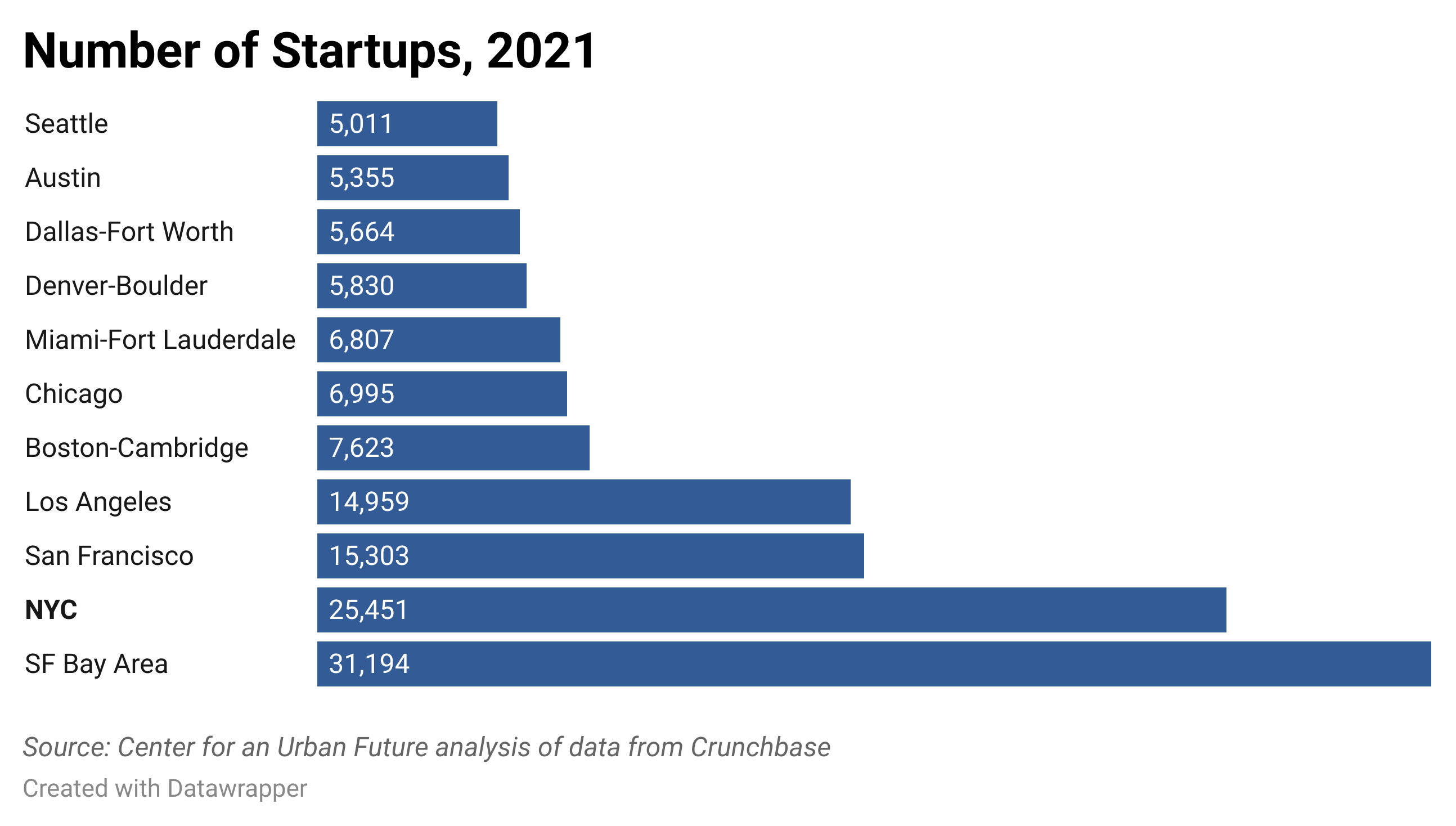

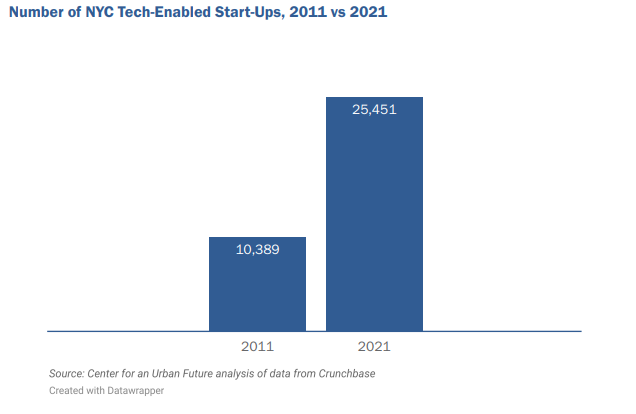

There are now 25,451 tech-enabled startups in New York City, according to our analysis of data from Crunchbase, a leading global database that tracks tech-enabled start-ups using a mix of public, private, and self-reported sources. This represents an incredible 145 percent increase from a decade ago, when there were 10,389 start-ups in the city.7

In addition to this spike in new start-ups, the past decade saw scores of tech companies experience exponential growth—transforming a sector that had previously been known primarily for thousands of small and mid-sized start-ups to one that now boasts many larger tech companies. For example, the average firm in the city’s “Internet publishing and web search portals” subsector increased in size from 18 employees in 2010 to 58 employees in 2020.8

Meanwhile, several of the nation’s largest tech companies have doubled down on New York, adding thousands of new positions in the city. For instance, Google had 2,000 employees in the city in 2010; it now has more than 12,000. Facebook, Amazon, and Apple together have another 11,000 jobs here—many times their total from a decade ago. As of 2020, Google’s employment in New York resulted in a direct economic impact of $7.9 billion and an indirect impact of an additional $5.1 billion, according to an analysis by the Bay Area Council Economic Institute.9

Several homegrown companies have become enormously valuable technological heavyweights. As recently as 2017, New York had not launched a single technology company with a stock market capitalization above $5 billion; now four publicly traded companies have market capitalizations greater than $8 billion: Datadog, Etsy, MongoDB, and UiPath.10

Datadog, a Midtown-based enterprise software company created in 2010, may be an unfamiliar name to many New Yorkers, but it now has a market cap of more than $27 billion, making it the most valuable tech firm based in the city. In May 2022, the company had over 190 job openings listed in New York.

In between tech giants and small start-ups are a vast collection of large and mid-sized startups, many formed in just the past decade, that have each grown to employ hundreds of New Yorkers. The Midtown-based online pharmacy company Capsule, for example, which was founded in 2015 and achieved unicorn status in 2021, employs about 1,000 people in New York, according to founder Eric Kinariwala. Justworks, a Lower Manhattan–based payroll and employee-benefit software start-up founded in 2012, has nearly 800 employees, all but a handful based in New York. Unqork, which makes no-code app-development software used by Goldman Sachs and city government, was formed only in 2017, and now employs around 320 people locally.

In a sign of the growing maturity of New York’s tech ecosystem, many of those companies’ founders have their roots in other New York-based firms. For example, former employees of the company Gilt Groupe, an online shopping website launched in 2007, have now gone on to form nearly 60 new companies, estimates Wendy Tsu, a partner at the New York venture capital firm AlleyCorp.

There’s also been a striking diversification in the types of firms starting and growing in New York City. As recently as ten years ago, says Jesse Beyroutey, general partner at the venture capital firm IA Ventures, “The stereotype would’ve been that New York companies were very commercial, and weren’t ambitious enough. A lot of them were in advertising or ecommerce. They weren’t in ‘mainline tech.’ You couldn’t build a top software-based company here, as an example.”

That perception has completely changed. New York remains a leader or major player in many fields where the city has been historically strong, like digital media and ad-tech. But the city has come into its own in a wide variety of other fields, too. “It’s not just a one-or two-category tech thing anymore,” says Tasso Argyros, founder and CEO of ActionIQ. “I think it’s an all-tech thing. And I think as time goes by, and as alumni of companies graduate to start their own companies, it’ll get even more diverse.”

For example, the city is now home to 939 real estate–focused tech start-ups, 872 fintech (or financial technology) start-ups, 752 start-ups working on artificial intelligence (AI), and 220 cybersecurity start-ups. There are also hundreds more start-ups working in travel (453), big data (433), wellness (425), fitness (385), blockchain (276), edtech (211), energy (176), pharmaceuticals (167), hardware (167), virtual reality (143), and women-focused products and services (123).11

The city’s tech ecosystem has also expanded in other important ways. For example, by June 2021, the number of initial public offerings (IPOs) for New York-based tech companies for the year had reached 12, already exceeded the total for the previous four years combined, according to data from EY.12 By the end of the year, the number reached 30, including marketing data firm Braze, website builder Squarespace, restaurant software platform Olo, and cloud infrastructure provider DigitalOcean.

The number of New York-based tech investors—including venture capital firms—has also exploded in the past decade, going from 621 VC firms and investors in 2020 to 1,790 today.13

“When we tried to raise money for our last start-up in early 2009, I don’t think we even talked to a VC firm in New York,” says Justworks founder Isaac Oates. “At the time, the way that you raised money for your company was that you flew to San Francisco, rented a car, and drove up and down Sand Hill Road [in Silicon Valley] to nondescript office parks to pitch VCs. I think that script has totally flipped.”

All of this has led to previously unfathomable increases in capital availability for New York-based tech companies. In 2020, despite the pandemic, venture capital investments in New York tech firms totaled a whopping $55 billion, the largest one-year total to date, according to CUF’s analysis of data from CB Insights. That’s up from just $11.2 billion in 2015—a 132 percent increase—and cementing New York’s position as second in VC funding only to the San Francisco Bay Area. New York also experienced the largest increase in venture capital investment of any U.S. metro area between 2012 and 2021.14

A Competitive Advantage for New York

The most successful urban economies are typically those that succeed in building a competitive advantage in one or more high-wage industries. New York previously did this in the securities industry (17 percent of the nation’s securities jobs are still located in New York City) and several creative sectors (15 percent of the nation’s film/TV jobs are here, as are 12 percent of advertising positions). Over the past decade, New York has begun to establish a major competitive advantage in tech, too, by nurturing a self-sustaining and increasingly diversified ecosystem replete with funders, founders and highly skilled employees— resulting in a large and growing share of the nation’s tech jobs.

New York City now accounts for 15.6 percent of all jobs nationally in Internet-related tech companies, nearly double its share from a decade ago (8.9 percent).15 New York also has an increasingly large share of overall U.S. tech sector employment, comprising 3.1 percent of the nation’s jobs in the sector, up from 1.7 percent fifteen years ago.

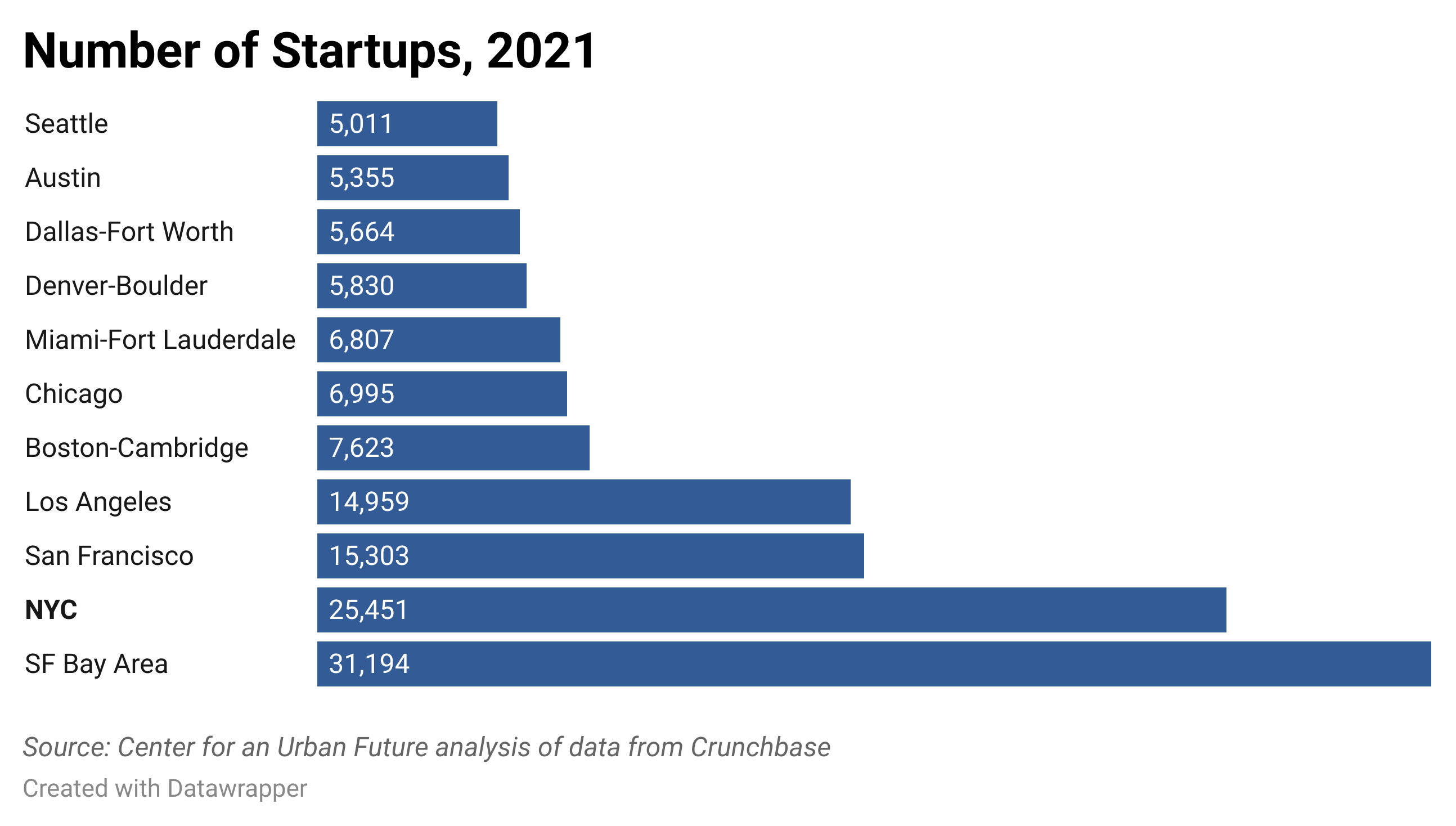

New York City also has more tech-enabled startups (25,451) than any place other than the San Francisco Bay Area (which has 31,194). In fact, New York has more start-ups than the city of San Francisco (which has 15,303) and nearly double that of Los Angeles (14,959). New York also has more start-ups than Boston (7,623), Miami (6,807), Austin (5,355), and Seattle (5,011) combined.

Reflecting these numbers, the New York metro region also received 15.9 percent of the nation’s venture capital investment in 2021, well ahead of every other region except the Bay Area, including Boston (which received 10.6 percent of VC dollars), San Jose (8.0 percent), Los Angeles (7.2 percent), San Diego (2.9 percent), Seattle (2.4 percent), Austin (1.5 percent), and Miami (1.4 percent).16

According to our analysis, New York was the only city in the nation besides San Francisco to add more than 100,000 tech sector jobs during the past decade—and New York’s employment growth rate outpaced that of every major city except San Francisco and Seattle.

Emerging Sub-Industries & Other Areas to Build On

New York’s success in developing a leading presence in several emerging tech sub-sectors suggests that the city’s tech sector is poised for even more job growth in the years ahead.

New York has seen the number of blockchain and cryptocurrency start-ups more than triple since 2016, growing from 110 to 338—a 207 percent increase. New York posted start-up growth of more than 50 percent in ten different subindustries since 2016, including wellness companies (+107 percent), artificial intelligence (+85 percent), retail technology (+69 percent), and augmented reality (+54 percent). Other notable subindustries experiencing strong growth include start-ups focused on providing products and services to women (123 firms, up from 83 five years ago); e-learning companies (176 start-ups, up from 120); and fintech (872, up from 576).

Facing New Headwinds

None of the founders, investors, technologists, and experts we interviewed for this report were pessimistic about the future of New York City’s tech sector. Indeed, most were downright bullish. But there is evidence that New York is facing new challenges that emerged during the pandemic which have the potential to grow into serious threats in the years ahead.

Chief among them is the rise of remote work, a trend that could begin to negate one of New York’s biggest advantages: its unmatched ability to attract talented workers and entrepreneurs. Indeed, over the past fifteen years, countless tech companies opted to start or relocate in New York despite the city’s sky-high costs—including office rents and taxes—because no other place gave them access to as large a pool of talent. But remote work has the potential to change this equation. It could induce some companies to move to less expensive locales, knowing that they can still hire employees that live in New York, or prompt engineers and other in-demand tech workers that are currently based here to move to cities with more affordable housing, shorter commutes, and higher quality of life—a development that could in turn convince additional tech companies to relocate. It’s also possible that tech companies will remain in New York but hire significantly fewer employees who live here.

In a 2021 survey, San Francisco–based VC fund Initialized found that 42 percent of its firms’ founders said that if they were starting a business today, the best place to locate it would be in the cloud, or as a decentralized company with remote workers in various locations.17 The founders we interviewed for this report generally told us that tech’s rapid embrace of remote work is here to stay, and that a growing willingness among employers to open up positions to remote candidates is helping start-ups find the talent they need to drive future growth. A May 2022 survey by Accenture Research and Tech:NYC found that 80 percent of the tech companies surveyed experienced employee resistance to returning to on-site work.18

Compounding the problem, just at the time when companies and workers are more mobile than ever, cities such as Miami, Austin, Nashville, and Los Angeles are making a convincing play for New York–based firms and talent.

Most visibly, Miami has been attracting an increasing number of fintech and blockchain companies—as well as a bevy of tech workers previously based in New York—because of its crypto-friendly mayor, its connections with Latin American markets, and its relatively high quality of life. (A recent executive order signed by California Governor Gavin Newsom creates a new regulatory approach to blockchain technology and could add further pressure on New York’s nascent ecosystem.) While it’s far from clear that Miami poses a legitimate threat to New York’s position in blockchain or other tech sub-industries, a recent Quartz analysis of LinkedIn data found that Miami saw a 15.4 percent increase in net migration of tech workers between March 2020 and February 2021 compared to the year before. In that same timeframe, there was an 18.2 percent decrease in net migration of tech workers from New York.19

Amid these shifting winds, several of the tech stakeholders and company founders interviewed for this report say that rising rents and the overall high cost of living in New York is a major concern, one which they fear will make it more difficult for them to attract and retain workers with the necessary skills.

Many of those we interviewed say that finding skilled employees is already their biggest challenge. Claroty, a New York–based cybersecurity firm, has its executive sales and marketing teams mostly based in Manhattan. But its engineering workforce is largely in Israel, where the company has said it has greater access to relevant talent. Likewise, UiPath’s leadership is in Manhattan, but the company still has significantly more employees Romania: 727, including most of its software development staff.

“Maintaining a team of developers in New York City is almost impossible now, unless you’re someone whose profits are astronomical and you’re just going to pay up for talent,” says Jonathan Truppman, chief legal officer at consumer-tech company Oddity and former general counsel of Casper.

Finally, a city bureaucracy described as “a slog”, according to one startup executive, is strengthening the value proposition presented by other cities and countries, especially when places from Austin to Uruguay are rolling out the red carpet for technologists and innovators. For start-ups that need to secure permits and approvals from city agencies, the challenges are even steeper.

“Some projects are taking over two years to permit, and really there’s no end in sight for others,” says Emmerick Patterson, head of acquisitions at MicroGrid Networks, a battery storage company. “There needs to be some leadership that helps drive these projects forward.”

Keeping NYC’s Tech Jobs Pipeline Growing

Despite the incredible gains in the tech sector over the past decade, this report concludes that additional job growth is far from assured and that city leaders will need to play a stepped-up role to ensure that New York’s tech sector achieves long-term sustainable growth.

As New York looks to cultivate the next era of tech sector growth, experts we interviewed say that the city would be wise to build on several areas of existing strength—and develop policies to make further progress by leveraging these areas.

Arguably one of the city’s greatest advantages compared to other major tech hubs is its diversity. Although the ranks of company founders and VC partners alike remain overwhelmingly white and male, the past decade has brought change to the sector, and these trends could accelerate in the years ahead with a new level of attention and investment from government and industry leaders. Today, New York is home to more than 120 startups focused on providing products and services to women, most of which are run by women founders. These include Maven Clinic, a woman-led telehealth company that this year became the first and so far only U.S. unicorn dedicated to women’s and family health, and Alloy, a start-up that provides medical guidance and treatment options for women experiencing menopause.

New York also benefits from a more diverse tech sector workforce than that of other major tech hubs, although major disparities remain. There are more Black workers employed in the seven core industries that make up the tech sector in NYC (17,874) than in the tech sectors of San Francisco, Boston/Cambridge, Seattle, and Los Angeles combined (13,588). Still, New York has a long way to go to achieve equity in tech sector employment. Black and Hispanic workers make up 43 percent of New York City’s overall workforce, but hold just one-in-five tech sector jobs. Overall, men hold three quarters (76 percent) of the city’s tech jobs, while women hold less than one quarter (24 percent).20

When it comes to another source of the city’s economic competitiveness—its embrace of immigration and globalization—experts see more room to grow. New York already serves as an entry point for foreign companies looking to plant a beachhead in the United States, and has developed initiatives like the In2NYC program to attract foreign entrepreneurs. But when it comes to attracting foreign investment and entrepreneurship, New York has room for improvement compared to peer cities. Over the past decade, New York finished a distant second to London for total inbound foreign direct investment from VC-backed firms, with 240 greenfield projects in London, compared to 115 in New York. New York closed out the decade with just 5.7 greenfield projects per one million residents—a significantly smaller share than London, Singapore, San Francisco, Berlin, Sydney, or Boston.21

Likewise, there’s little doubt that New York’s academic institutions have made a substantial effort tgrow their involvement in supporting tech innovations over the past decade. All of the more than one dozen accelerators in Columbia University’s Lab-to-Market (L2M) Accelerator Network were created in the last 12 years. NYU Tandon created four “Future Labs” spread across Brooklyn in the wake of the 2008 financial crisis. Cornell Tech’s Runway Startup Postdoc Program teaches recent PhDs in digital technology fields to shift from an academic to an entrepreneurial outlook. And CUNY is home to multiple accelerator programs, including CUNY Startups’ New Venture Accelerator and Queens College Tech Incubator.

But with additional strategic support, those academic institutions could play an even more central role. PitchBook’s latest rankings of undergraduate and MBA programs by the number of VC-backed founders among their alumni, for example, put Columbia University at 15th and NYU at 21st, far behind schools in California and Boston. SUNY is ranked 49th; CUNY did not make the list.22

Endnotes

- This report finds that New York City’s tech sector now employs 194,000 people, as of December 2021. But that figure was derived by using the Federal Reserve Bank of New York’s narrow definition for measuring employment in the tech sector that almost certainly undercounts the true size of the sector. Other analyses have found that the broader “tech ecosystem” in New York employs 372,000 people.

- To examine the racial/ethnic and gender composition of employment in each city’s tech sector, we analyzed 17 tech-specific occupations, such as database administrators, web developers, and computer network architects, using data from the 2019 American Community Survey.

- Crain’s New York Business, “The tech sector will grow ... elsewhere?” January 10, 2022.

- sf.citi, “Tracking San Francisco’s Tech Exodus,” March 2022, https://sfciti.org/sf-tech-exodus.

- New York City’s tech sector now employs 193,929 people, as of December 2021.

- CUF’s measurement of the sector’s employment aggregates job totals in seven industries “in which firms use technology as their core business strategy”: Computer Manufacturing, Electronic Shopping, Software Publishing, Data Processing & Hosting, Internet Publishing & Broadcasting & Web Search Portals, Computer Systems Design and Scientific R&D Services.

- CUF analysis of data from Crunchbase, a leading global database that tracks tech-enabled start-ups using a mix of public, private, and self-reported sources. Analysis is for 2011 and 2021.

- Analysis of U.S. Bureau of Labor Statistics, QCEW data set. In 2010, the Internet publishing and web search portals in New York County had 410 firms employing 7,214 people and in 2020 it had 752 firms employing 43,615.

- Economic impact analysis by the Bay Area Council Economic Institute, using the IMPLAN model, and shared with the authors.

- Market capitalization figures as of May 24, 2022.

- CUF analysis of data from Crunchbase.

- Crain’s New York Business, “Inside a red-hot year for New York tech IPOs,” June 25, 2021, https://www.crainsnewyork.com/technology/inside-red-hot-year-new-york-tech-ipos.

- CUF analysis of data from Crunchbase.

- Richard Florida, “The Post-Pandemic Geography of the U.S. Tech Economy,” Bloomberg City Lab, March 9, 2022.

- Measures NYC’s share of national employment in the “Internet publishing and web search portals” industry.

- Richard Florida.

- Kim-Mai Cutler, “Post-Pandemic Silicon Valley Isn’t a Place,” Initialized, January 21, 2021, https://blog.initialized.com/2021/01/data-post-pandemic-silicon-valley-isnt-a-place.

- Accenture Research and Tech:NYC, “NYC Tech Hiring Trends, May 2022, https://www.accenture.com/content/dam/accenture/final/industry/high-tech/document/Accenture-research.pdf.

- Nicolás Rivero, “Miami’s tech boom started with a tweet but is sustained by more than hype,” Quartz, December 4, 2021, https://qz.com/2098280/miamis-tech-scene-is-still-booming-after-a-year-of-hype.

- CUF analysis of data from the U.S. Census Bureau 2019 American Community Survey.

- Alex Irwin-Hunt, “The global map of venture capital-powered FDI,” fDi Intelligence, June 26, 2020, https://www.fdiintelligence.com/content/rankings-and-awards/the-global-map-of-venture-capitalpowered-fdi-77759.

- Jordan Rubio and James Thorne, “Top 50 college for founders,” PitchBook, November 17, 2021, https://pitchbook.com/news/articles/2021-pitchbook-university-rankings-top-50-colleges-founders.

.png)