New York City has lost more than 777,000 jobs since February, affecting nearly every part of the city’s economy. But the toll taken by the coronavirus pandemic has differed strikingly by industry. This new analysis reveals that while a half-dozen industries shed at least 50 percent of their job totals between February and June, 20 other sectors have managed to keep job losses under 8 percent. At the same time, more than a dozen industries have already recovered at least a third of the jobs lost in the early months of the pandemic, while roughly the same number of sectors have recaptured fewer than 10 percent and a handful of industries have yet to bring back any jobs.1

Major findings of our analysis include:

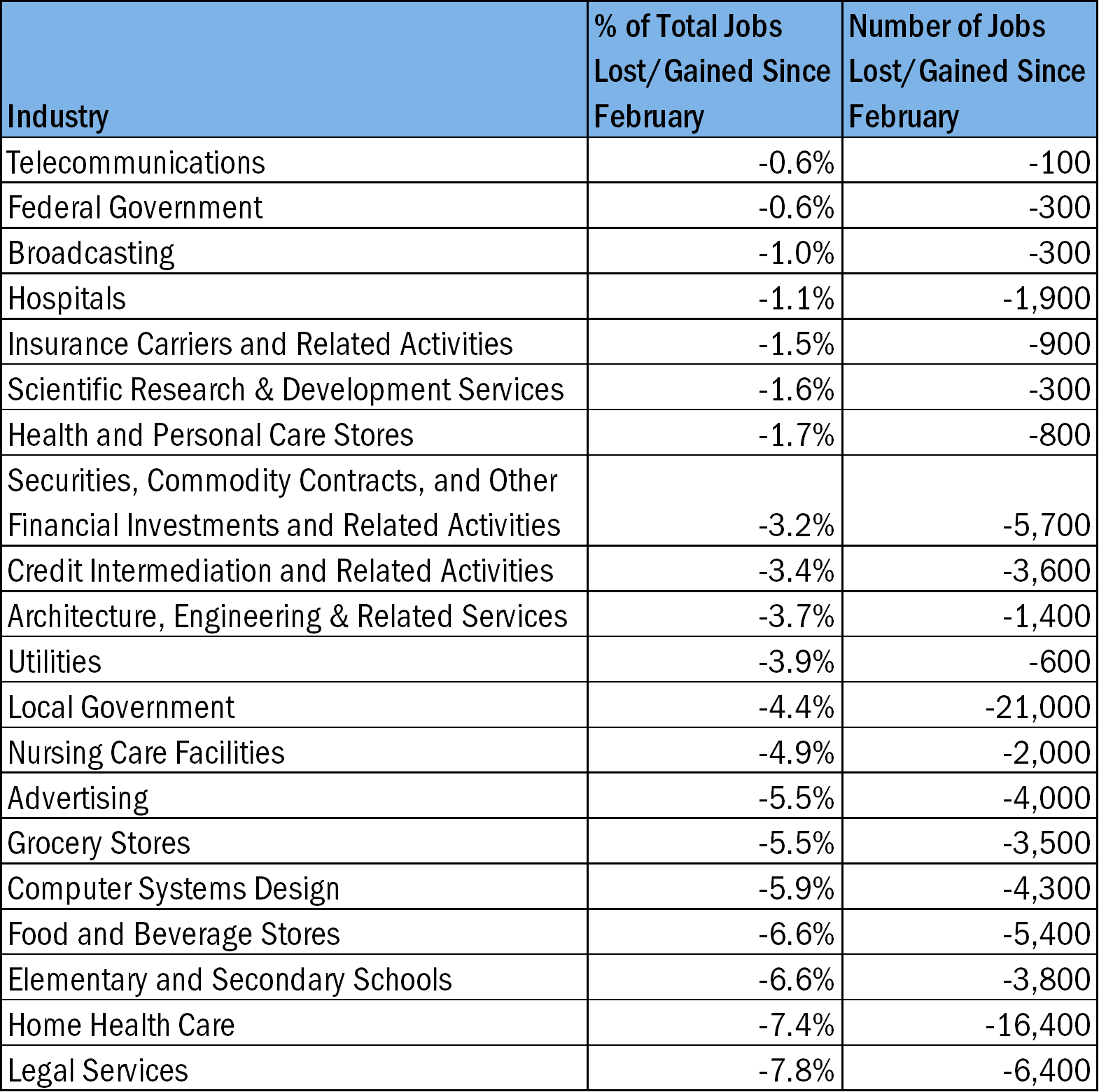

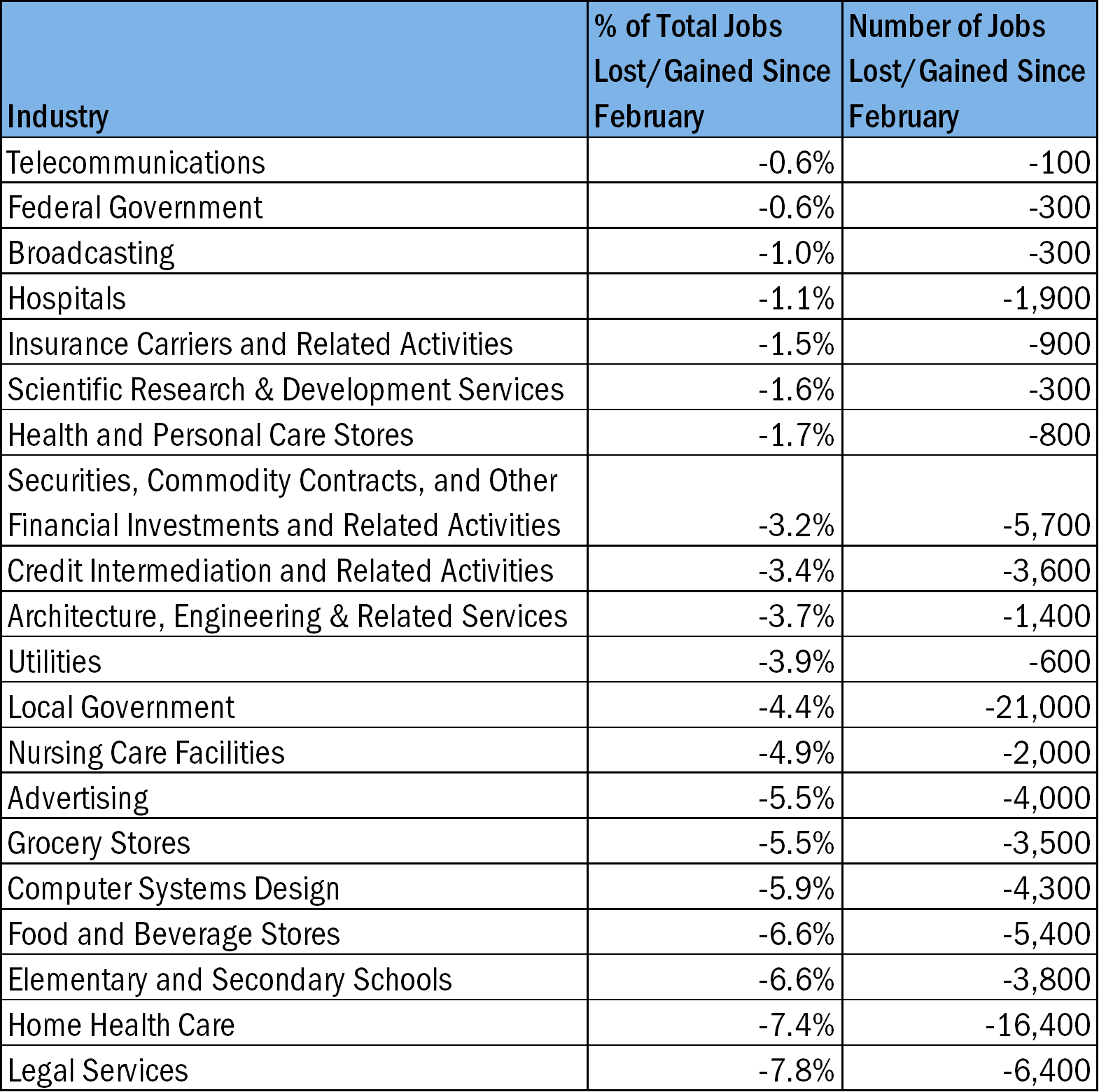

- The 20 industries with comparatively minimal employment declines (under 8 percent) between February and June are largely concentrated in a handful of sectors: 1) professional services, especially creative industries, finance and insurance, the tech sector, and legal services; 2) hospitals and other parts of the healthcare sector; 3) utilities and telecommunications; and 4) grocery stores and other food-related retail.

- Creative Industries: cable & other subscription programming (+2.6 percent increase in jobs), publishing (+0.9%), radio and television broadcasting (-2.3%), architecture, engineering & related services (-3.7%), advertising (-5.5%). By comparison, the motion picture & sound recording industry has seen somewhat steeper losses (-11.6%).

- Finance & Insurance: Insurance carrier & related activities (-1.5%), securities, commodity contracts, and other financial investments and related activities (-3.2%), credit intermediation and related activities (-3.4%)

- Tech: Scientific research & development services (-1.6%), computer systems design (-5.9%)

- Other Professional Services: Legal services (-7.8%)

- Healthcare: Hospitals (-1.1% decline in jobs), nursing care facilities (-4.9%), home health care (-7.4%)

- Utilities & Telecommunications: Telecommunications (-0.1%), utilities (-3.9%)

- Food Retail: Grocery stores (-5.5%), food and beverage stores (-6.6%)

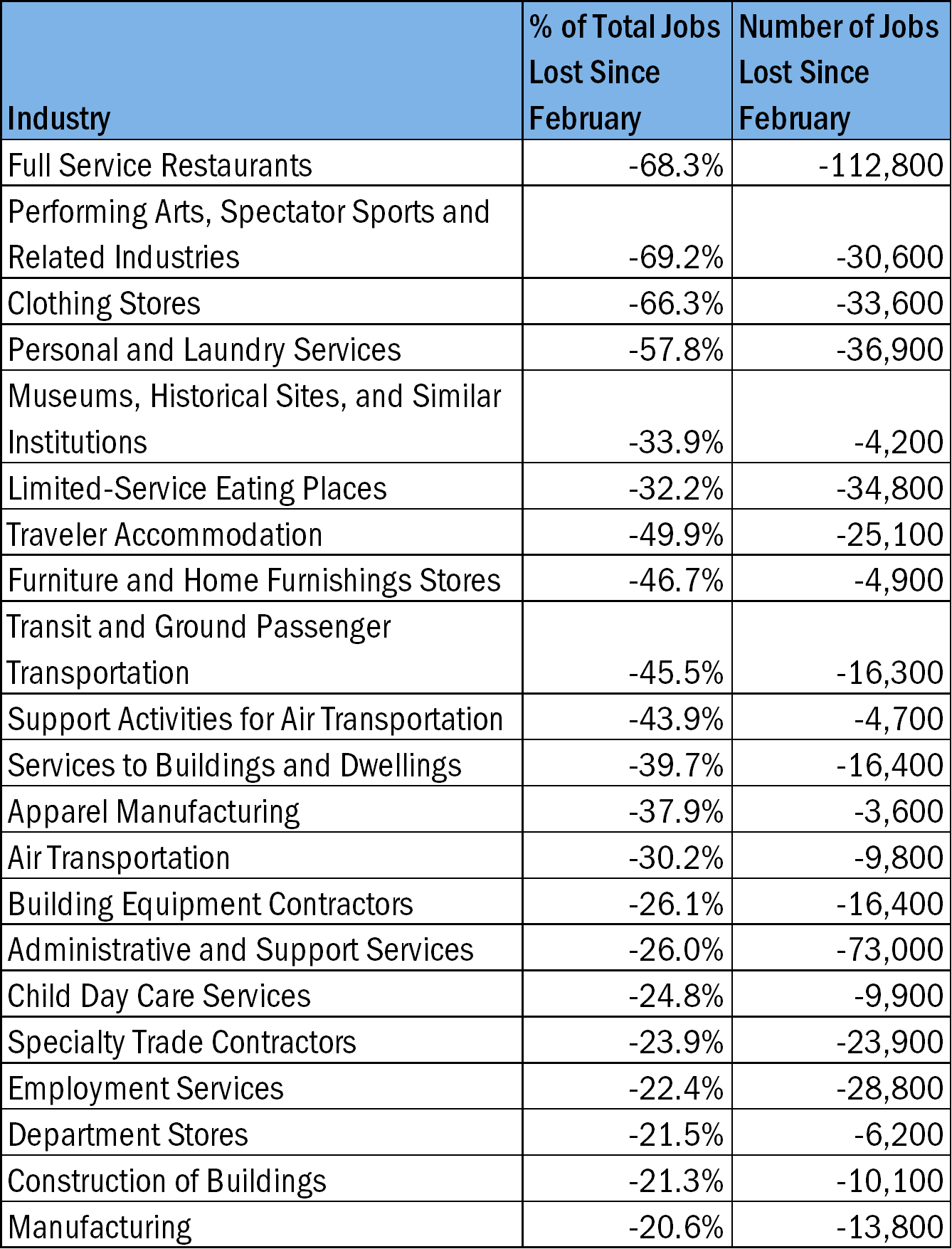

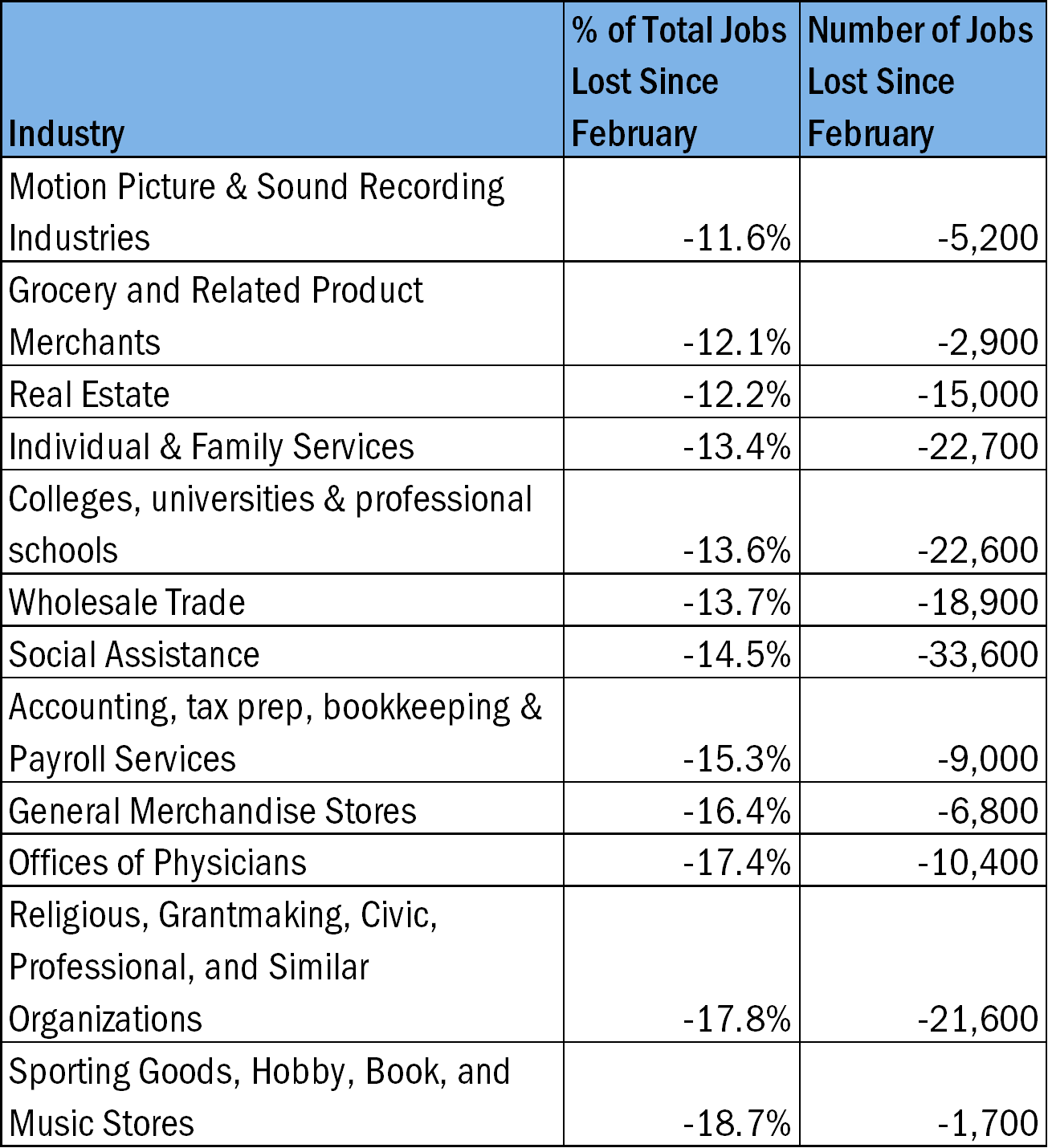

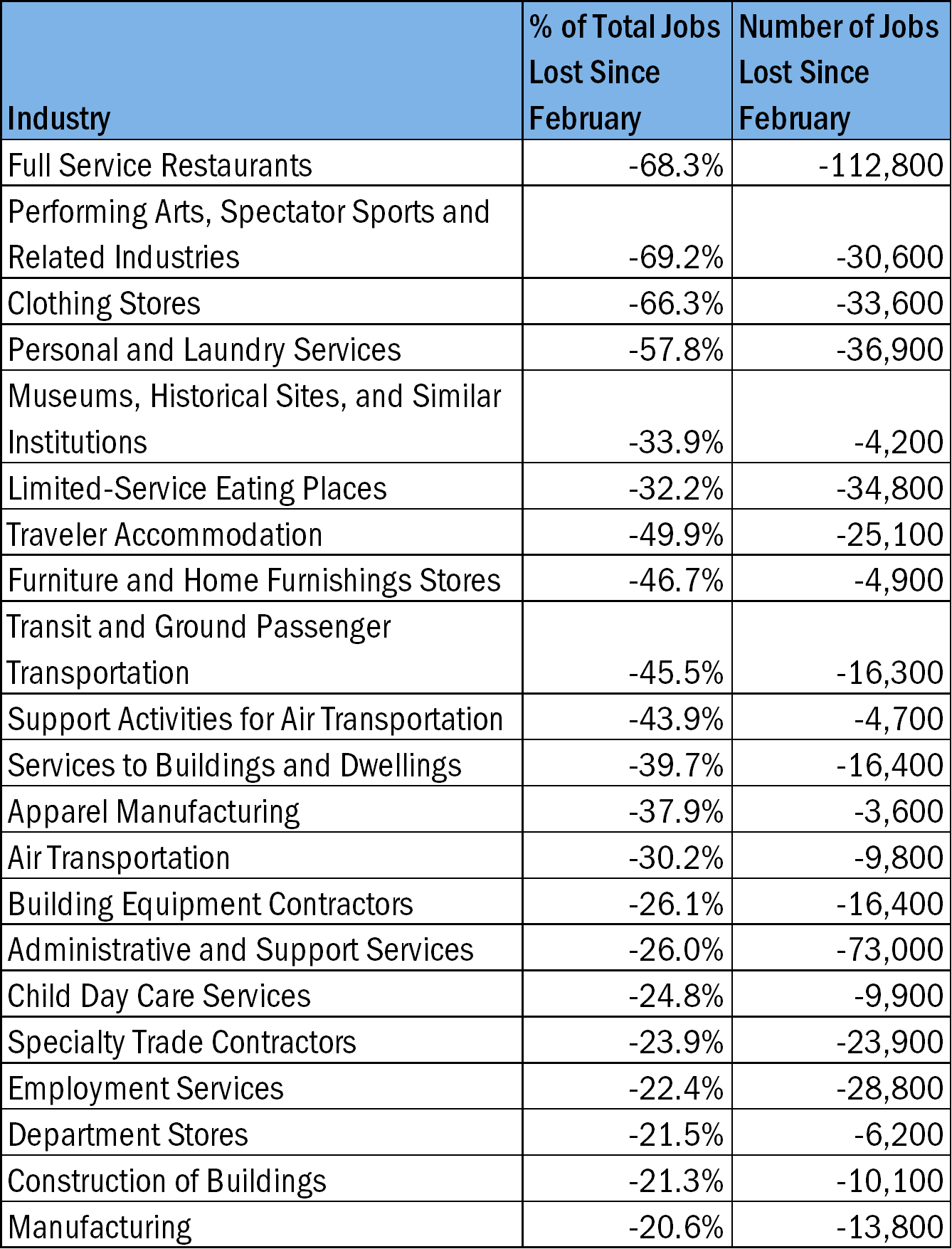

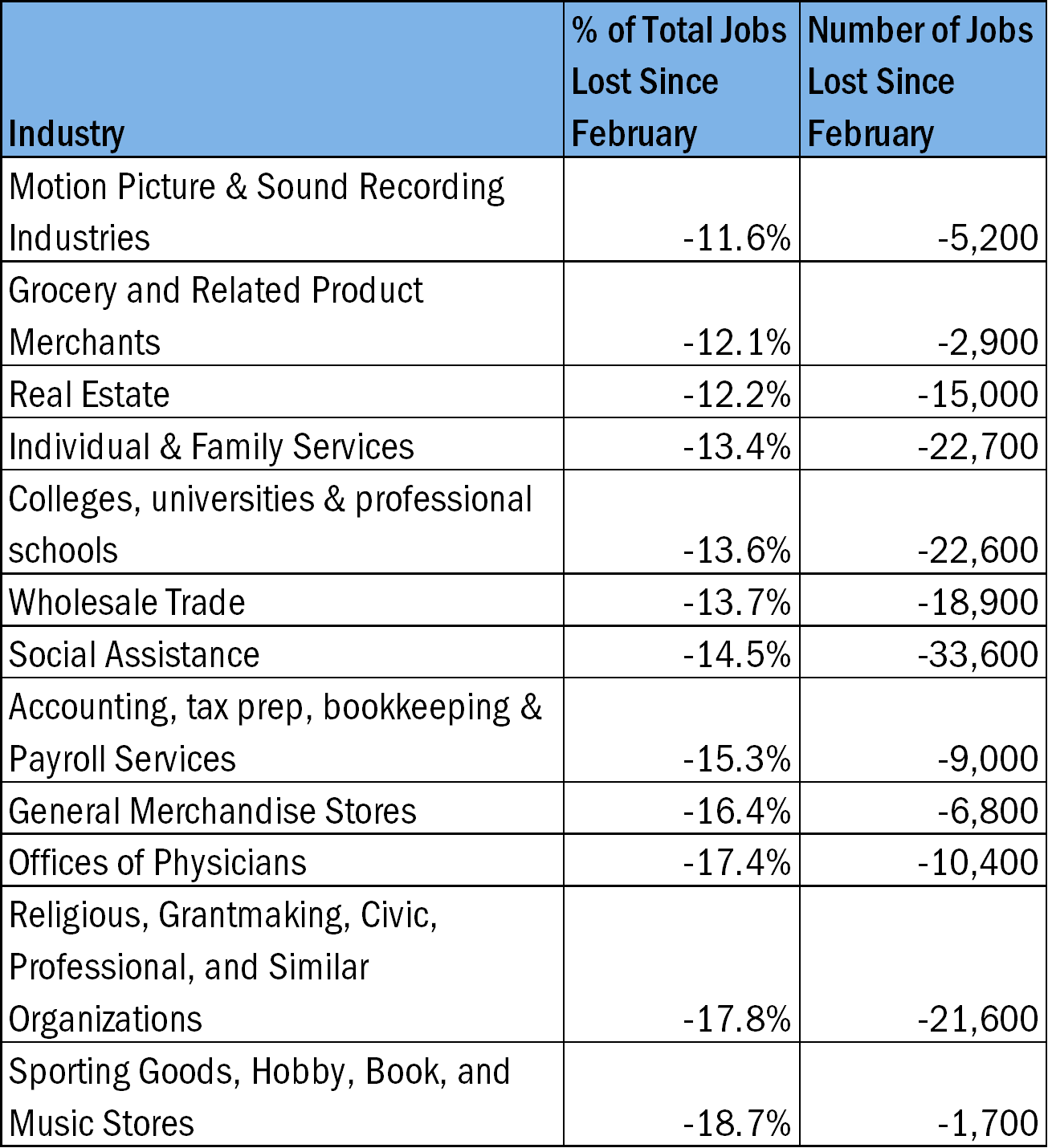

- In six industries, employment totals have fallen by 50 percent or more since February. Eleven other industries suffered losses between 20 and 50 percent. These hard-hit industries include many face-to-face service sectors and industries reliant on tourism, although other industries have been badly hurt as well. This includes restaurants, accommodations, arts and entertainment, retail, transportation, personal care and laundry services, child day care services, administrative and support services, construction, and manufacturing. While many professional business services industries have held up relatively well in this pandemic, one of the most accessible parts of the professional business services category—administrative and support services (which includes janitors, security guards, landscapers, pest control workers, office clerks, and office temp workers)—has seen significant employment declines.

- Arts & Entertainment: Performing arts, spectator sports and related industries (-69.2%), museums, historical sites & similar institutions (-33.9%)

- Restaurants: Full-service restaurants (-68.3%), limited-service eating places (-32.2%)

- Retail: Clothing stores (-66.3%), furniture and home furnishings stores (-46.7%), department stores (-21.5%)

- Personal and laundry services (-57.8%)

- Traveler accommodation (-49.9%)

- Transportation: Transit and ground passenger transportation (-45.5%), support activities for air transportation (-43.9%), air transportation (-30.2%)

- Manufacturing: Apparel manufacturing (-37.9%), manufacturing, total (-20.6%)

- Administrative & support services: Services to buildings and dwellings (-39.7%), employment services (-22.4%), investigation & security services (-20%)

- Construction: Building equipment contractors (-26.1%), specialty trade contractors (-23.9%)

- Child care services (-24.8%)

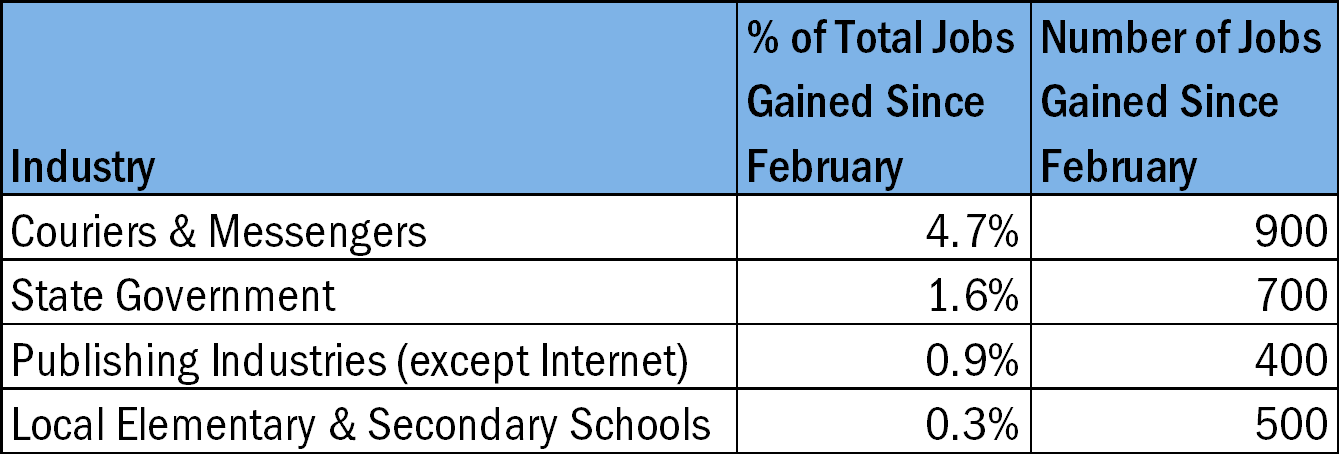

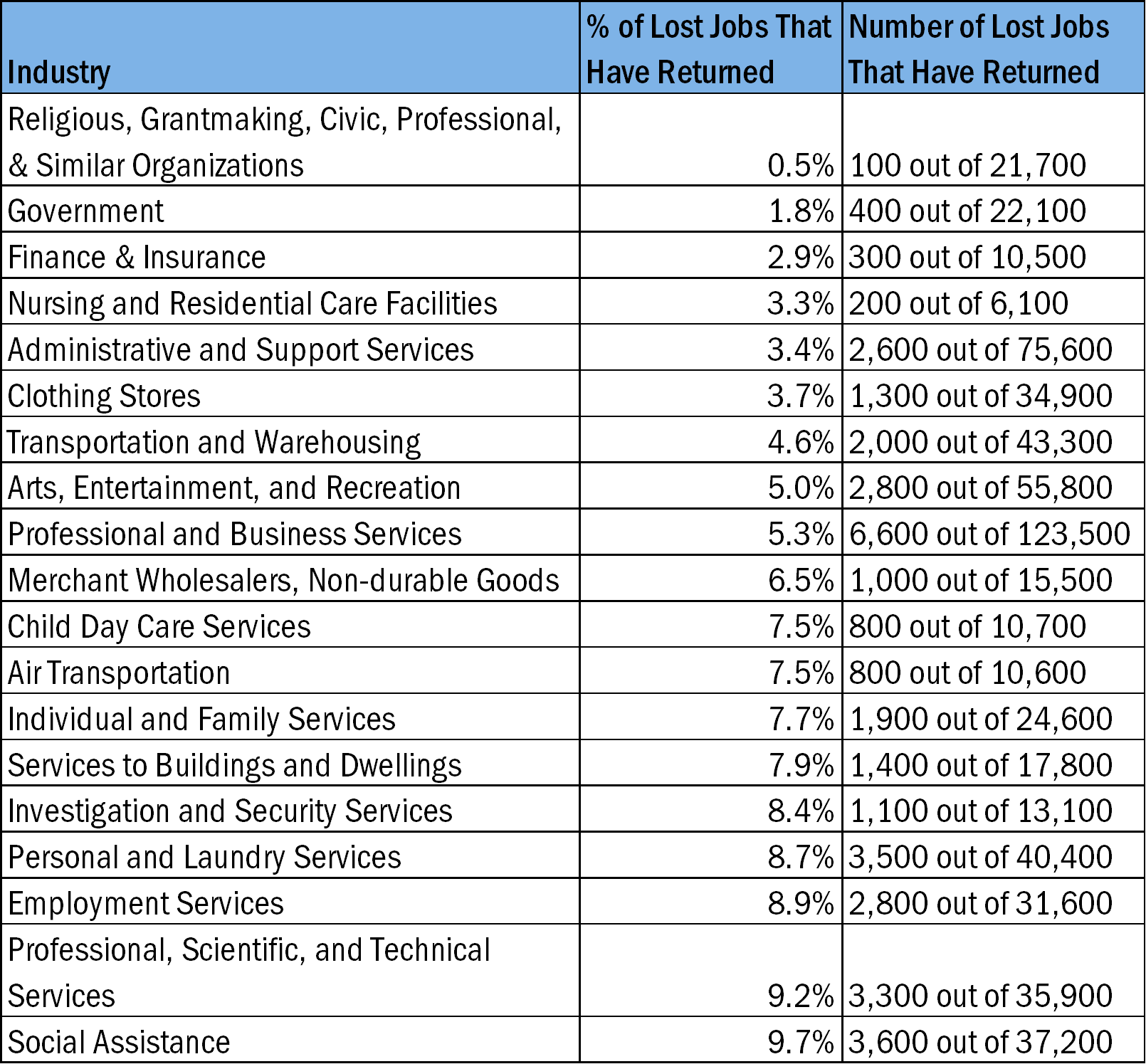

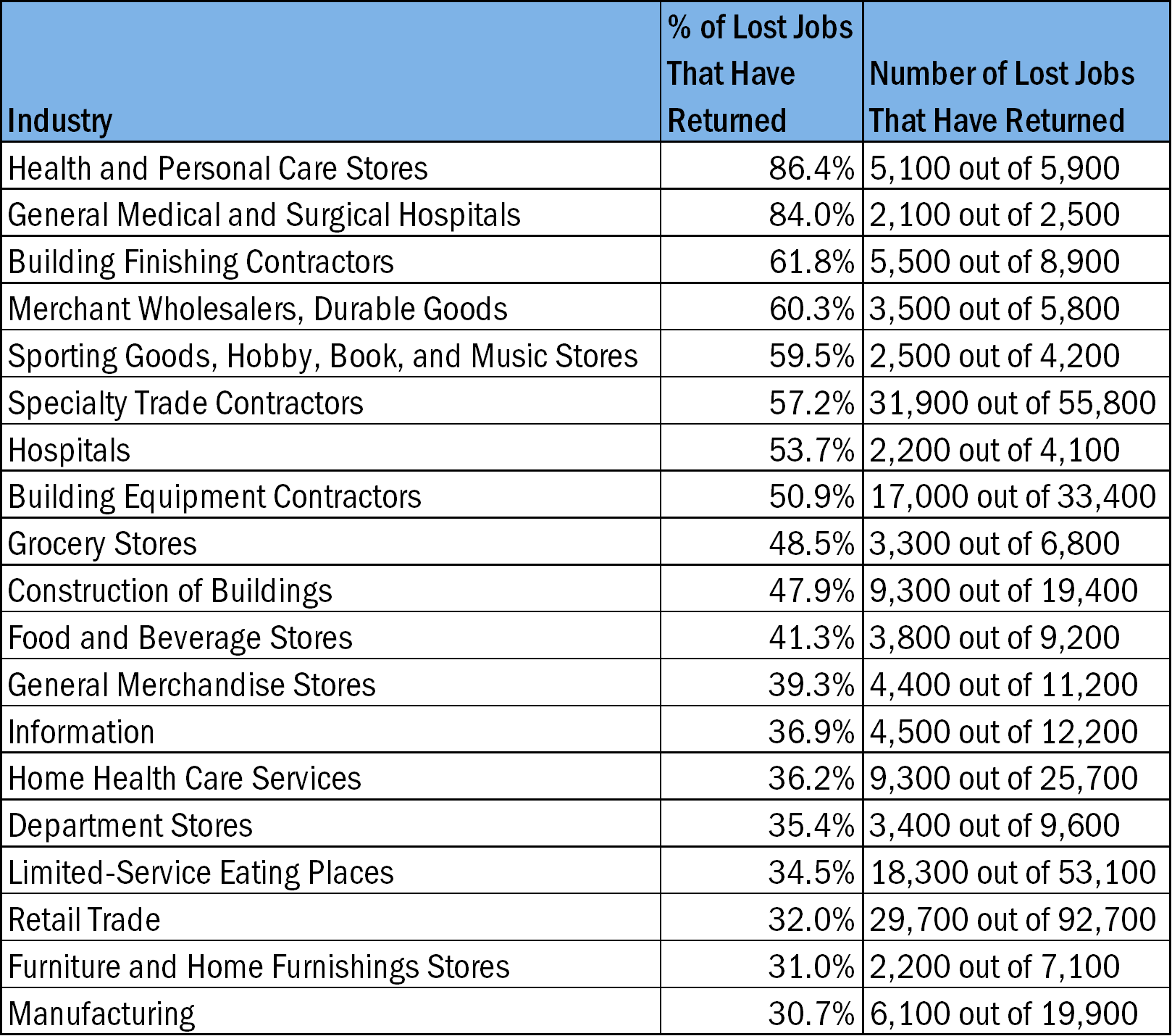

- Several industries have recovered a significant chunk of the jobs lost in the early months of the pandemic, but many other sectors have made far less progress and some fields are still shedding jobs.

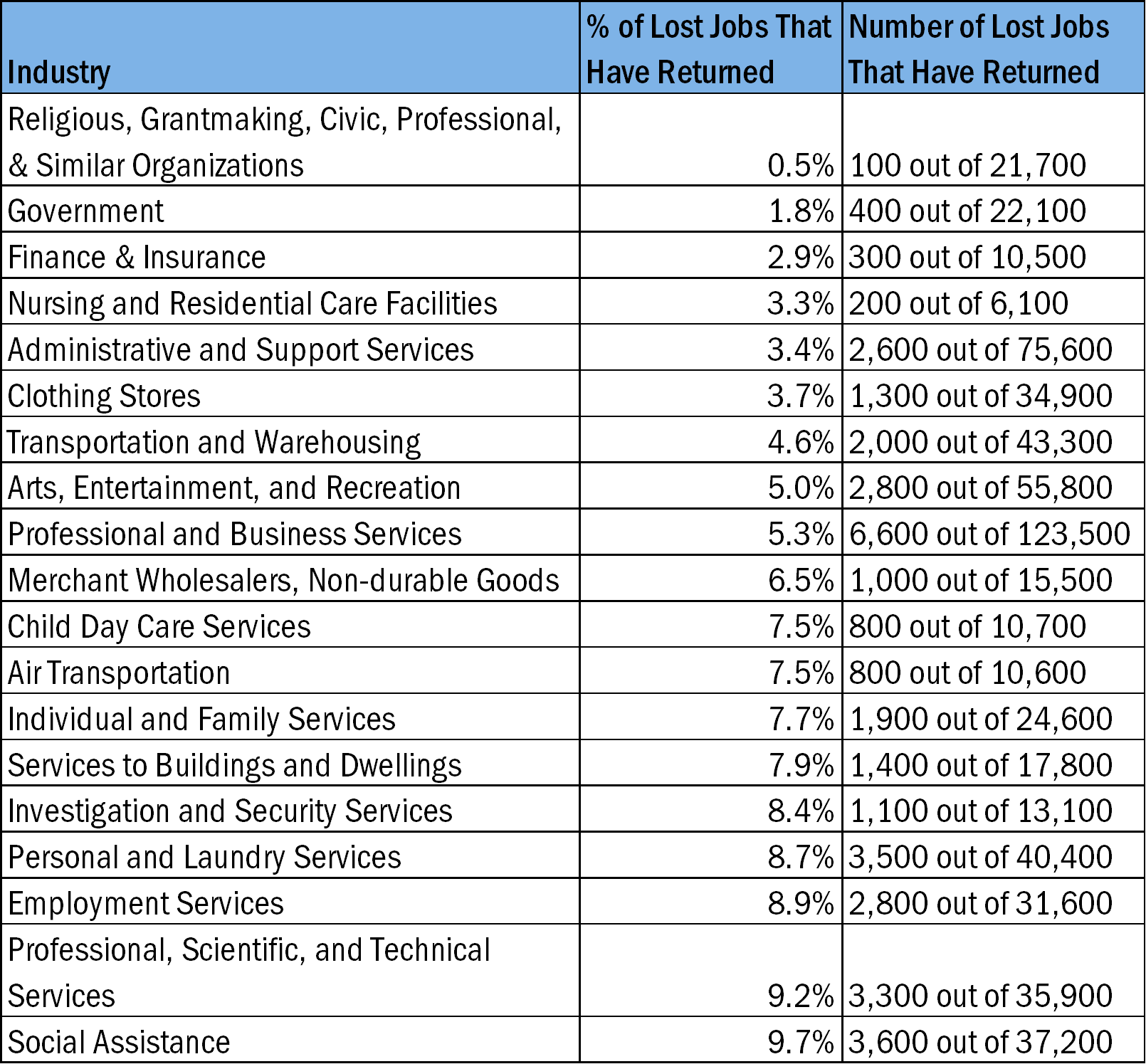

- As of June, just 3.7 percent of the jobs lost at clothing stores (1,300 out of 34,900 positions lost) have come back. A similarly small share of jobs have returned in the arts, entertainment, and recreation sector (5.0 percent of those lost), child day care services (7.5 percent), air transportation (7.5 percent), and social assistance (9.7 percent).

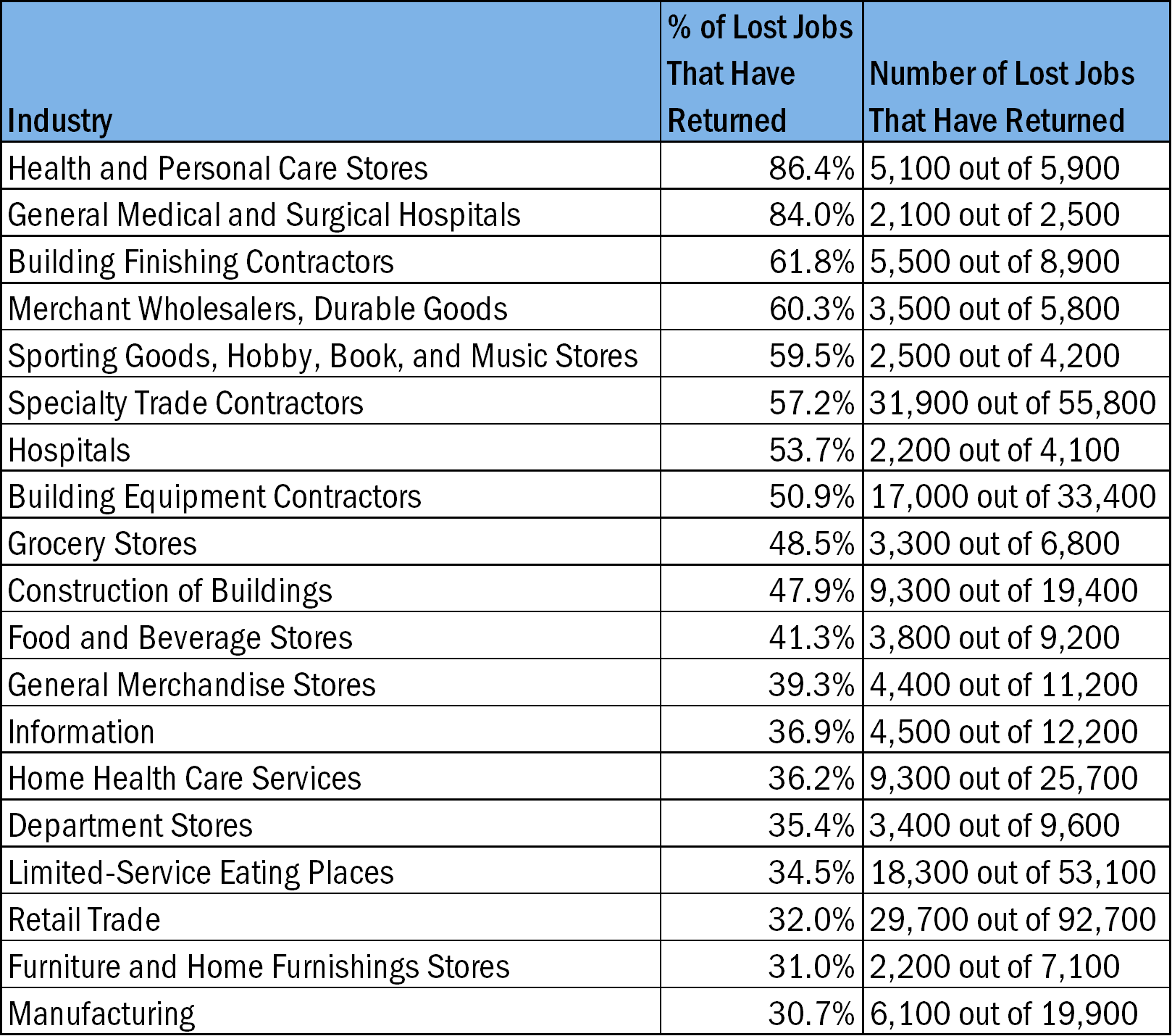

- In contrast, 53.7 percent of the jobs lost at hospitals across the city have returned, as have 48.5 percent of jobs at grocery stores, 86.4 percent at health and personal care stores, and 59.5 percent at sporting goods, hobby, book, and music stores. Meanwhile, several segments of the construction industry have recaptured a comparatively large share of jobs, including building finishing contractors (61.8 percent of jobs have returned), specialty trade contractors (57.2 percent), and building equipment contractors (50.9 percent).

- While the majority of the city’s industries hit a low point for employment in April or May and have since begun a recovery, a small group of industries continued to lose jobs through June. For instance, performing arts, spectator sports and related industries lost another 3,000 jobs between April and June after earlier losing 27,600 from February to April. Employment in the transit and ground passenger transportation sector declined by 3,200 since April, after suffering 13,100 in job losses from February to April. Employment in colleges and universities declined by 19,100 since April, after only experiencing 3,500 job losses from February to April. Apparel manufacturing, museums, education services, investigation & security services, and real estate rentals & leasing all hit new lows for total employment in June.

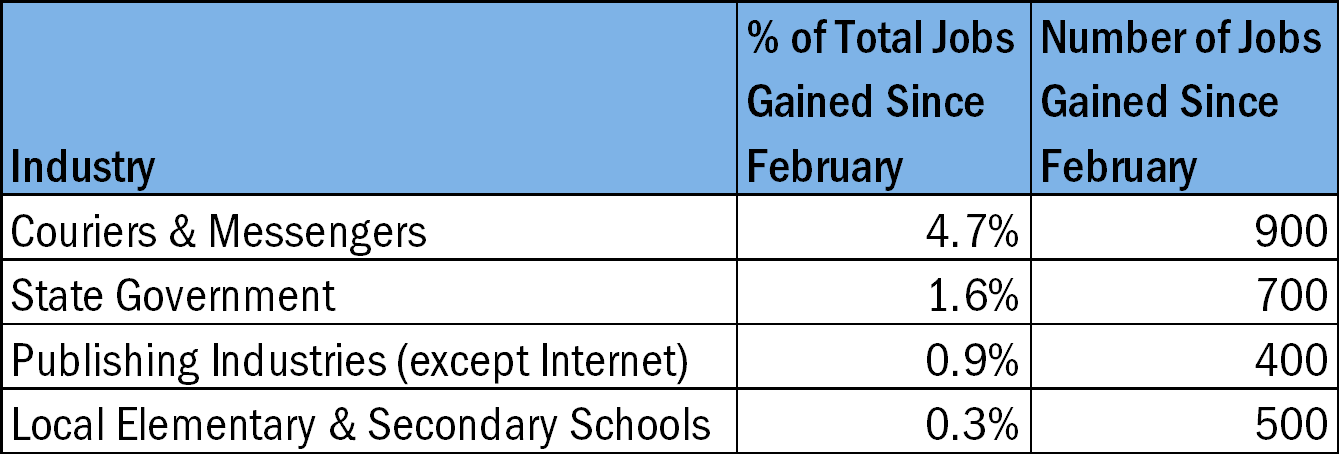

- 10 industries have either returned to or surpassed their jobs total from February, including publishing, and couriers & messengers. The 10 sectors are:

- State government education (0%)

- Community food and housing, and emergency and other relief services (0%)

- Local elementary & secondary schools (+0.3%)

- Publishing industries (+0.9%)

- Nondepository credit intermediation (+1.6%)

- State government (+1.6%)

- State government hospitals (+2.1%)

- Cable & other subscription programming (+2.6%)

- Couriers and messengers (+4.7%)

- Other residential care facilities (+7%)

- Only one industry didn’t lose any jobs since February (state government education)

Industries that have lost a comparatively small share of their jobs between February and June

Industries that have lost a large share of their jobs between February and June

Industries that lost a moderate share of their jobs between February and June

Industries that have had a net gain in jobs between February and June

By June, the following industries had recaptured less than 10 percent of the jobs lost between February and the trough reached in either April or May:2

In contrast, more than 30 percent of lost jobs have returned in the following industries:

Notes

1. This report analyzes data from the U.S. Bureau of Labor Statistics’ monthly Current Employment Survey, as tabulated by the New York State Department of Labor.

2. Only includes industries with 2,500 or more job losses between February and either April or May.