Over the past decade, the tech sector has emerged as one of the most important generators of new middle-income jobs in New York City. Employment in the city’s tech sector has increased 71 percent since 2006, to more than 117,000 jobs. These positions pay roughly twice as much, on average, as the jobs being created in other fast-growing industries such as retail, restaurants, and healthcare.

There is clear potential to maintain this growth, thanks to the city’s strength in a diverse array of tech fields—from advertising and finance to digital media and ecommerce. But few parts of the city’s tech ecosystem are growing as quickly or offer as much potential for future expansion as digital health.

The ongoing transformation of healthcare delivery in the United States has sparked tremendous growth in the digital health sector. With hospitals, insurance companies, doctors and other health providers under unprecedented pressure to provide higher quality care at a lower cost, a crop of new businesses has sprung up to meet the challenge. These firms are building digital tools that will help the healthcare system transition from paper to electronic records, analyze big data to better manage chronically ill patients, conduct virtual consultations with patients and perform other key functions more efficiently than they ever could before.

New York City is already one of the primary beneficiaries of this growth. Today, the city is the nation’s second-largest center for digital health innovation, behind only Silicon Valley. In less than a decade, the city’s digital health sector has grown from just a handful of companies to nearly 100 digital health companies, ranging from large consumer-facing information providers to dozens of start-ups creating essential tools that healthcare providers are building into their back-office systems and using every day to improve patient care. In addition to sheer numbers, several of the city’s digital health start-ups have achieved significant growth. Indeed, a disproportionate share of the city’s most well-funded tech start-ups are in the digital health sector.

The industry experts and investors we interviewed for this report believe that New York is in a prime position to capture a significant share of this emerging industry’s future growth. But while entrepreneurs in the field are drawn to New York’s strong healthcare infrastructure and proximity to the insurance and pharmaceutical industries, start-ups in the sector face several challenges that could constrain future growth.

The upside is clear: the city could create thousands of well-paying jobs in a sector that’s poised for continued growth. But as this study illustrates, New York will need to step up to help this burgeoning sector reach its full potential.

This report—the latest publication of the Center for an Urban Future’s Middle Class Jobs Project, a research initiative funded by Fisher Brothers and Winston C. Fisher— provides a comprehensive analysis of New York City’s digital health sector. The report is based on data aggregation and more than 20 interviews with executives of local digital health companies, academics who train students to enter the field, and venture capitalists and angel investors who are funding it. The report also includes input from managers of digital health incubators and accelerators in the city, as well as experts who are embracing these new technology tools as they guide the transformation of healthcare—once an entirely paper-based industry—into the digital age.

It is that transformation from paper to electronic health records and other new tools that has made digital health one of the fastestgrowing subsectors of the technology industry. Nationwide, investors poured a total of $6 billion into digital health in 2015, according to public data aggregated by New York–based StartUp Health. And in the first half of 2016 alone, $3.9 billion was invested in the sector—a 39 percent increase over the first half of 2015, and 11 percent higher than the previous first-half record set in 2014. The average venture capital (VC) round is expanding in digital health, as well. In 2015, the average deal size was $13 million, more than double that of 2013.

| Top Digital Health Employers in NYC |

|---|

| Company | Number of Employees (2016) |

|---|

| WebMD | 1,750 |

| Medidata | 1,500 |

| ZocDoc | 600 |

| Everyday Health | 700 |

| Flatiron Health | 375 |

| Oscar | 300 |

| medCPU | 86 |

| Fit4D | 70 |

Source: Employment figures are based on interviews and media reports.

| Most Well-Funded Digital Health Companies in NYC |

|---|

| Company | Funding (millions) |

|---|

| Oscar | 727.5 |

| Flatiron Health | 313 |

| ZocDoc | 225.52 |

| Peloton Interactive | 127.74 |

| Phreesia | 74.85 |

| WorldOne | 60 |

| medCPU | 54.2 |

| Progyny | 49.02 |

| Quartet Health | 47 |

Source: Data collected for CUF by CB Insights, December 2016

A confluence of factors is driving the growth of digital health. Advances in data processing, mobile and cloud computing, and encryption are making it feasible for health providers to digitize medical records, appointment schedules, and other data while maintaining compliance with strict privacy laws. At the same time, the Affordable Care Act (ACA) and other new legislation demands that insurers and healthcare providers embrace electronic health records, decrease hospital readmissions, and provide higher quality care at a lower cost.

The ACA also expanded Medicaid access, opening up a whole new market for the digital health industry, as state-based health agencies look for technology tools to help them administer their programs efficiently. As of the end of 2016, 25 states had implemented Medicaid expansion, including New York, and another six states were in the process of implementing expansion programs, according to the National Conference of State Legislatures.

Despite efforts by President Donald J. Trump and congressional Republicans to repeal all or parts of the ACA, the United States is continuing to shift away from a fee-for-service model and toward value-based care. The Medicare Access and CHIP Reauthorization Act (MACRA) of 2015, which passed with bipartisan support, is just one of many recent laws and initiatives, both local and national, which incentivize health providers to focus on quality.

That’s why most healthcare experts believe the drive to provide higher quality care at a lower cost will continue to grow, fueling the demand for new digital health products that improve efficiency and reduce waste. The demand is coming from providers themselves, who want to use technology to improve their practices, as well as from patients seeking to do everything from scheduling doctors’ appointments online to getting medication reminders from electronic pill bottles. “This is not just policy—this is the march of history,” says Jeffrey Sachs, a principal at the New York–based healthcare consultancy Sachs Policy Group. “The digital revolution has been happening in every other sector, it’s finally coming to healthcare, and we can see how it’s going to transform every part of our lives.”

New York City is a major hub in the digital health ecosystem, one that’s poised to grow in the years to come. Experts agree that the both the quantity of digital health companies and the funding they’ve raised make New York City the number two player in the industry behind the San Francisco Bay Area.

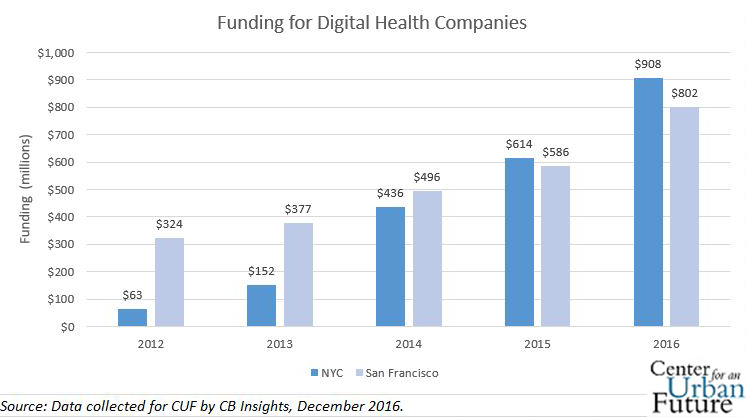

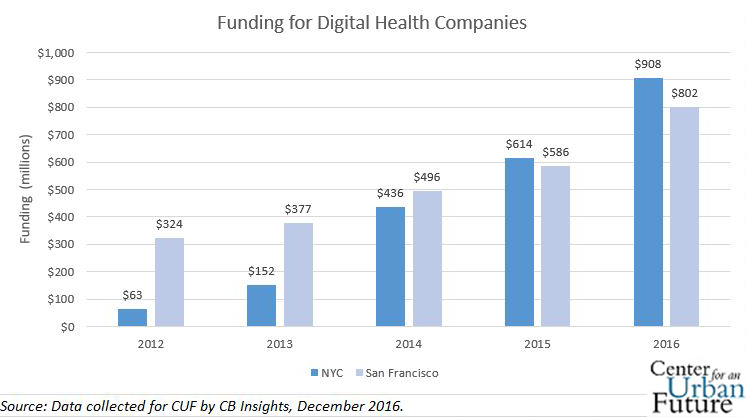

The city has seen an explosion in digital health companies starting up and getting funded over the past five years. In 2010, just 15 digital health companies in the city raised venture funding, bringing in a total of $93 million.5 Five years later, 67 local companies raised $614 million, according to information gathered by data aggregator CB Insights for this report. And though the total deal count dropped in 2016, CB Insights recorded $908 million in total VC funding for digital health companiesin New York City, making it the sector’s best year to date.

Digital health is reaping a larger share of funding than other segments of the technology industry. An analysis by the Center for an Urban Future shows that of the $1.16 billion in venture capital poured into New York–based tech companies in the first quarter of 2016 alone, more than 18 percent was invested in healthcare information technology, versus 15 percent in financial technology, 12 percent in enterprise software, and smaller proportions devoted to other types of digital start-ups and to biotechnology.

New York has traditionally lagged behind the Bay Area in VC funding for digital health, but that has started to change over the past three years, thanks largely to three huge Big Apple success stories. Oscar, a health insurance company that provides care via mobile app to customers in New York, California, and Texas, raised $728 million in six funding rounds. ZocDoc, an online medicalappointment scheduler, had raised $93 million in three funding rounds prior to 2011 and then pulled in another $130 million in 2015. Flatiron Health, a maker of cloud-based software used for oncology research and treatment, brought in $313 million in three rounds.

New York has stayed well ahead of Boston in VC funding for digital health, despite that city’s much bigger life sciences sector. Boston-based digital health companies raised $139 million in 2016, according to CB Insights, and just $97 million in 201510. New York’s lead underscores the fact that it has not only the second-highest concentration of venture capitalists behind San Francisco, but also a deep healthcare infrastructure, says Maria Gotsch, president and CEO of the Partnership Fund for New York City. “A competitive advantage of New York is that we have an extensive concentration of leading healthcare systems, as well as payers,” she says.

The healthcare services sector in New York City is projected to grow 42 percent in the ten years ending in 2022, according to a report from the New York State Department of Labor. Data collected by the City of New York shows that it is home to 11 hospital centers and 70 ambulatory care clinics employing more than 40,000 people.

And New York has two of the largest nonprofit health systems in the country, Northwell Health and New York–Presbyterian, and several major academic medical centers, including New York University and Mount Sinai, all of which are major investors in digital health products. In November 2016, for example, New YorkPresbyterian launched a new venture fund, NYP Ventures, which will devote $15 million to fostering digital health startups, many of which are making tools it intends to field test in its hospitals. The city also enjoys close proximity to the heart of the insurance industry, which has been embracing digital tools.

Digital health has been a strong creator of jobs in New York, largely because some of the industry’s pioneering firms are based in the city. One of these market leaders is Medidata Solutions, a publicly traded company founded in 1999 that makes cloud-based systems to help drug companies manage clinical trials. Medidata now has a market value on Wall Street of $3 billion. Also based in the city is consumer health provider WebMD, founded in 1996 and trading with a market value of $2 billion. Medidata and WebMD each employ more than 1,500 people. ZocDoc and Everyday Health, another consumer information information provider, each employ more than 500.

All told, we have identified more than 80 digital health companies in New York City developing a wide range of technology products. They include consumer-facing tools like ZocDoc, as well as Noom, which provides weight-loss coaching and other lifestyle-based services, and Talkspace, which offers mental health counseling both online and on smartphone apps.

This sector also encompasses technologydriven health delivery systems, where New York is clearly a leading player. In addition to Oscar, the city is home to Sherpaa, a company that connects doctors with patients needing urgent answers to medical questions via a mobile app.

But the fastest growing segments of the city’s digital health industry are business-to-business (B-to-B) and business-to-business-to-consumer (B-to-B-to-C) technologies. These companies build software and other tools designed to help health systems meet certain goals, such as making use of big data to improve efficiency, or to streamline interactions between health providers and patients.

The unparalleled size of the healthcare sector in the city creates not just a large and growing talent pool, but also a huge market of customers for technologies made by digital health companies. At the same time, one big demographic trend is driving the demand for digital health: the millennial generation—some 1.6 million New Yorkers reared on technology— expect to have digital access to their health services. Mario Schlosser, co-founder and CEO of Oscar, told the audience at the 2016 Forbes Healthcare Summit in New York that when the company reached out to 18,000 of its members in 2016 to help them through a change of health plans, “the main mode of communication was text messaging and chatting in email basically, and messages through the apps we have.” Only 3 percent of phone calls made by Oscar were returned, he added, reflecting the necessity of digital communication for reaching younger consumers.

Photo credit: everthing possible / Shutterstock.com