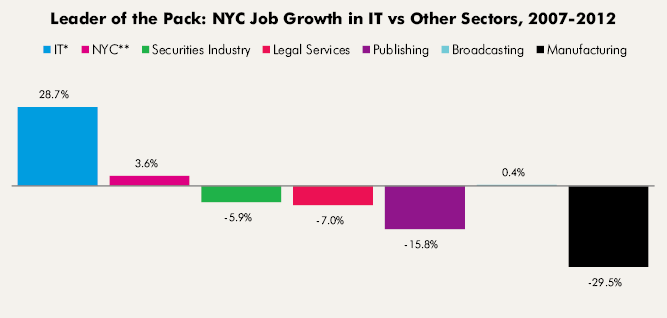

There are many other indications of New York’s stunning gains in tech.

There are now more than 23,000 members of New York Tech Meetup, the membership organization for those involved in the city’s tech community. This is double the number of members in December 2009 (11,500) and nearly triple the figure from October 2008 (7,500).

Of the seven leading technology regions in the United States, New York was the only one to see an increase in the number of VC deals between 2007 and 2011, according to data from the MoneyTree report published by PricewaterhouseCoopers and the National Venture Capital Association. Amazingly, the number of deals shot up by 32 percent in New York during this period. In contrast, venture activity was down significantly in every other region, including Silicon Valley (-10 percent), New England (-14 percent), LA/Orange County (-8 percent), Texas (-17 percent) and San Diego (-38 percent). Nationally, there was an 11 percent decline in VC deals.

There were almost as many tech-related VC deals in New York City in 2011 (165) as in 2006 and 2007 combined (172), according to data from SeedTable. And the number of digital companies in New York that exited, or got acquired by other firms, was actually larger in 2011 (55) than in 2008 and 2009 combined (54).

Most of the nation’s largest tech companies are now planting roots in New York, something that didn’t seem likely five or six years ago but has lent legitimacy to the city’s upstart tech industry. Google opened a major office in New York in 2006, and made a deeper commitment in 2010 when it purchased its office building, 111 Eighth Avenue, for $1.8 billion. But even more recently, Facebook has committed to building an engineering campus near Grand Central while Twitter, eBay, LinkedIn, and Yelp have all announced plans to develop major offices here.

Importantly, start-ups are also relocating here. We identified well over a dozen established tech start-ups that have moved to New York in recent years from the San Francisco Bay Area, Boston and other locations. James Wahba, founder of Projective Space, says that “a good 30 percent” of the start-up founders working out of his coworking facilities moved to New York to create their company. And at least 28 New York-based tech start-ups were founded by students from Harvard Business School. This is noteworthy because even a few years ago, HBS graduates who moved to New York were mainly doing so to work on Wall Street. And those who were opting to go the entrepreneurial route were often doing so in Boston or on the West Coast. Now they are literally flocking to New York to become tech entrepreneurs. Indeed, in April, Boston-based venture capitalist Jeff Bussgang said that about a third of students surveyed in his Harvard Business School entrepreneurship class expect to relocate to the Big Apple.

Of the seven leading technology regions in the U.S., New York was the only one to see an increase in the number of VC deals between 2007 and 2011.

The flood of tech start-ups in New York is on display at the dozen or so incubators and coworking spaces that have opened in the city in the past few years. By our count, these shared spaces have already housed nearly 500 tech start-ups. General Assembly, perhaps the city’s best known tech incubator, opened its New York campus in January 2011. A little more than a year later, GA has 350 members, representing upwards of 100 early stage start-ups. Already, 16 of its dedicated member start-ups have graduated from the space over the past year. GA also attracts 3,000 attendees each month for classes, events and other events. “People move to New York to take our classes,” says Brad Hargreaves, one of GA’s founders.

Five or six years ago, New York-based entrepreneurs routinely complained about the difficulty attracting financing, whether from venture capital firms or angel investors. Early stage financing was particularly lacking in the city. Indeed, in June 2008, Mayor Bloomberg noted that “many smaller start-up companies have difficulty accessing seed capital to get off the ground.”

But today, the city is awash in capital for startups. “There was no structured institutional seed capital in the city pre-2008,” says Owen Davis, managing director of NYCSeed, which was created in 2008 to provide seed-stage funding. “By 2010 there was more capital than ever for seed investing in the city.”

Local angels and venture funds have greatly increased their level of funding for local start-ups. Robinson says that 70 to 75 percent of the investments made by RRE Ventures today are in New York, compared to under 50 percent in 2004 and 15 to 20 percent in the mid-1990s. The same has happened with New York Angels, the most prominent angel investment group in the city. “Several years ago we were doing probably 40 percent of our deals in New York,” says David Rose, founder of New York Angels. “Now, I think it is closer to 70 or 80 percent.”

While the availability of capital has been crucial to the growth of the city’s tech economy, the strides New York has made in developing a tech “community” or ecosystem have arguably been even more important. Indeed, this was one of the critical missing pieces in New York during the go-go days of Silicon Alley in the late 1990s. “The New York New Media Association had 8,000 members at the height of the boom,” says Rose, speaking of the major industry association for the city’s dot com companies. “But the problem was that there was no ecosystem. It was like grass that was growing on concrete.”

Even in the mid-2000s, New York still lacked a robust tech ecosystem. A 2007 article about the city’s tech scene concluded that “finding tech culture in New York in 2006 took a little bit of digging.”

That’s all changed. There is a growing community of technologists in the city, in part because entrepreneurs, developers and engineers are moving here in droves. Amazingly, about half of Tumblr’s 103 employees are “relos,” according to David Karp, the company’s founder. All of these techies are now finding a welcoming and supportive ecosystem at every turn. There are routinely more than a dozen tech-related meetups a day, in addition to hackathons, start-up weekends and tech-related events. Meanwhile, a growing number of organizations provide aspiring entrepreneurs with advice, connections and the opportunity to pitch ideas to investors. At the same time, the number of successful tech entrepreneurs in New York has multiplied in recent years, and many of them are making angel investments in other start-ups and serving as mentors.

“It’s a very vibrant community that’s growing and multiplying rapidly,” says Divya Gugnani, the founder of fashion tech company Send the Trend. “What’s so amazing is that there are networks of entrepreneurs in New York now. In 2008, I knew five entrepreneurs in New York that I could call and have a conversation with. Now, I can call 500 people in New York. Literally, from 2008 to 2012, that’s how much my network has grown on the tech side, because there just so many more companies and so many more people starting businesses.”

From an economic perspective, the best news for New York is that this does not appear to be a temporary blip. While it’s likely that a good number of the recent start-up companies in New York will not succeed, virtually everyone interviewed for this report—including several people based outside the city—believes that New York is extremely well-positioned for even more tech sector growth in the future.

“New York is well suited to where tech is going,” says Jalak Jobanputra, managing director for venture firm RTP Ventures. “Maybe Silicon Valley will continue to build the next chip sets, hardware, and certain types of apps, but the expertise we have in New York is well-suited to the next generation of tech companies.”

The future is bright for New York in part because of the ecosystem that has developed here in recent years, which has left the city with much stronger foundation to build upon than was the case in the late 1990s. But more importantly, so many trends in the tech world today play to New York’s strengths.

The early days of technology growth was driven by semiconductors and computer hardware, products that depended on a deep roster of engineering talent and required large amounts of physical space to develop—neither of which favored New York. In contrast, today’s growth is being fueled by the Internet and smart phones, and the creation of new ways of taking advantage of these now widely used platforms to deliver content, sell products, deliver services, play games and simplify life for individuals and businesses. New York’s rich pool of creative, marketing and business talent is well-suited for creating and running these new businesses, all of which can be built with comparatively few engineers. At the same time, today’s technology revolution is much less about creating the infrastructure and plumbing for the Internet, but about applying technology to traditional industries like advertising, media, finance, fashion and health. New York is natural for this wave of technology growth because it is a market leader in most if not all of these sectors, and boasts an unmatched concentration of talent in each of these fields.

On top of these advantages, New York’s startup boom has benefited from a precipitous decline in the cost of developing an Internet business and the availability of new platforms where entrepreneurs who aren’t coders can go to get a Website built for a small amount of money.

Our research suggests that there is considerable room for additional growth in the years ahead. On one level, individual consumers and businesses are still in the earliest stages of using and adopting the innovative Internet and mobile technologies being created in New York and elsewhere. Most analysts expect that demand will only increase, especially as the use of smart phones explodes in the coming years. Some technology sub-sectors that are strong here, like financial technology and social media, still have a lot of growth ahead of them. Meanwhile, other traditional industries like health care and energy have only begun to be disrupted by technology. Many of those interviewed for this report believe that health tech could be next to take off, and New York is already positioning itself as one of the two or three leading regions in this field. Others say that media applications using video have real potential for growth here.

Moreover, the proliferation of successful tech start-ups, the emergence of serial entrepreneurs and creation of a sustainable ecosystem in New York is likely to feed on itself in the coming years, just as Silicon Valley evolved and grew over decades—not years—when successful tech entrepreneurs started second and third companies, became angel investors in other start-ups and even started VC firms. With every successive generation, the city is building up more of a critical mass of experienced technology entrepreneurs and talent, more mentors and more capital. And with each success, the city is building buzz and creating an impression among investors, entrepreneurs and engineers based elsewhere that this is one of the leading places to build a tech company.

While there is clear cause for optimism, there is also a lot that New York’s tech sector hasn’t yet achieved. None of the major tech IPOs in the last couple of years—including Facebook, LinkedIn, Groupon and Angie’s List—involved New York companies. Even the Boston region has about 30 tech companies with billion dollar market capitalizations, while New York has just a few.

In addition, some of the highest flying tech companies in the city have recently hit some rough patches. Gilt Groupe, arguably the largest Internet start-up in the city with about 900 employees, trimmed 10 percent of its staff earlier this year. SecondMarket, the online private equity market, recently announced it would lay off 15 of its 130 jobs. Lot18, the high-flying online wine and gourmet food seller, cut its workforce by 15 percent in January after growing from six employees to 90 in about a year.2 Flash sales aggregator MyNines shut down last year.