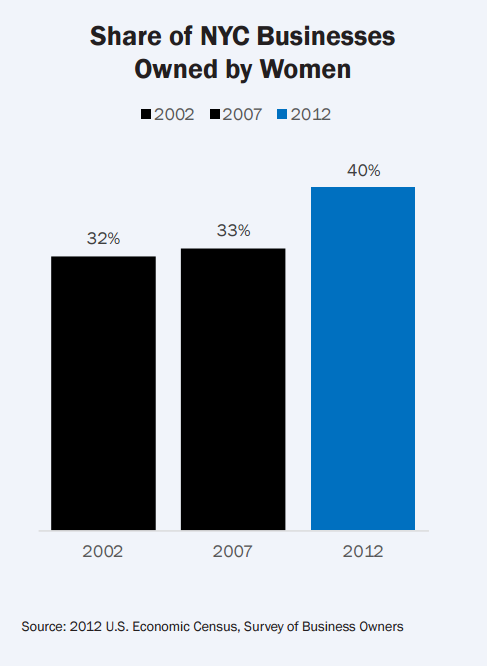

As technology disrupts entire industries in New York City, another disruption is taking place right alongside—a flood of women entrepreneurs in virtually every industry in the city. Women founders of all ages, races and ethnicities are creating jobs, bolstering the city’s economy, strengthening families and neighborhoods, and providing new and creative solutions to the problems of modern life. Fueled by advances in technology, lowered barriers to entry and recession era lay-offs, women throughout the city—from stay-at-home moms to fashion designers and finance pros—are starting and growing new businesses at a remarkable clip.

This research was made possible through Capital One’s Future Edge initiative, a $150 million, five-year effort to help more American workers and entrepreneurs succeed in the 21st century economy. Through Future Edge, Capital One works with hundreds of leading community and nonprofit organizations in NYC and beyond, including microfinance and micro-lending organizations empowering women entrepreneurs such as Grameen America, Accion, and the Business Outreach Center Network. Learn more at www.capitalone.com/investingforgood or join the conversation on Twitter at @YourFutureEdge.

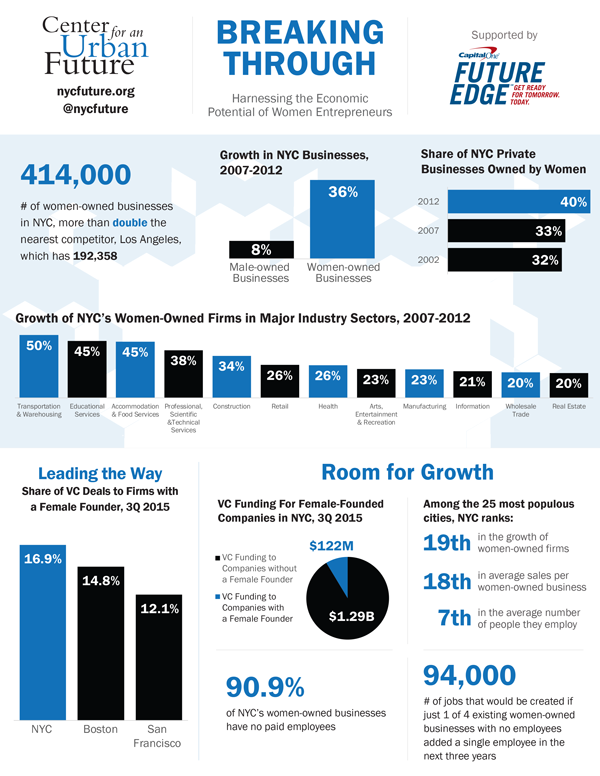

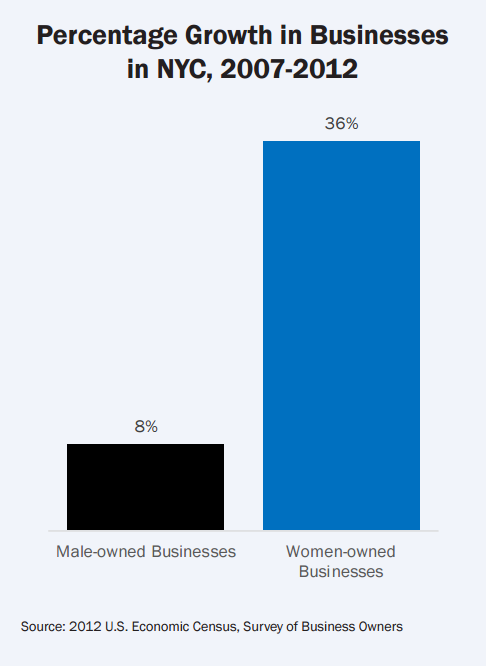

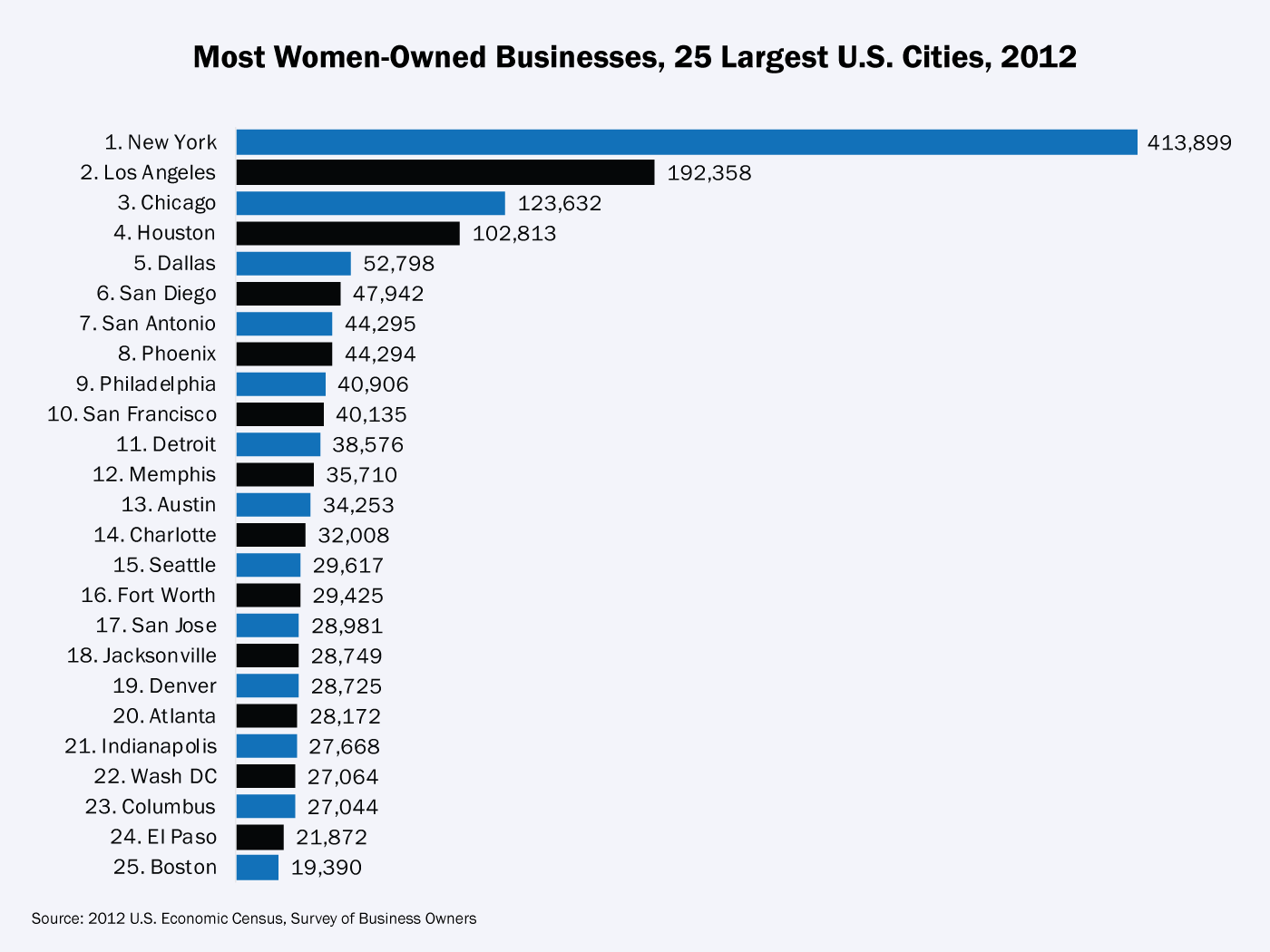

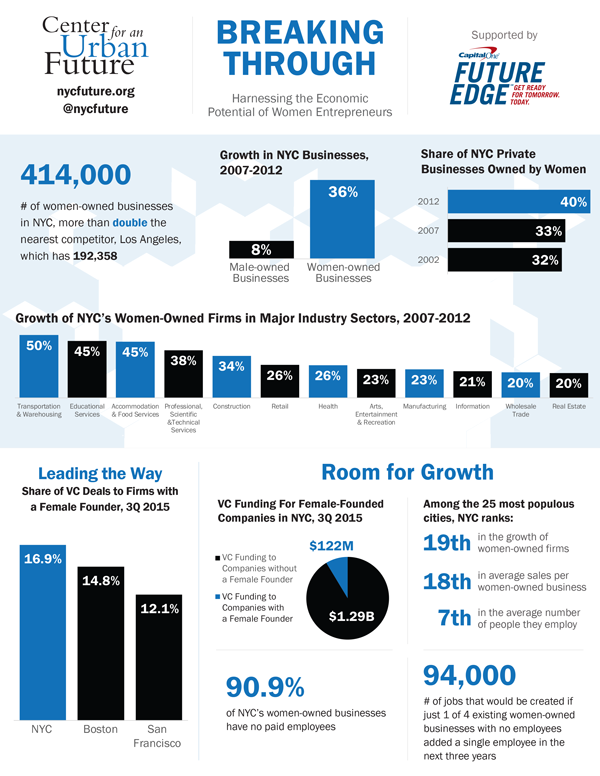

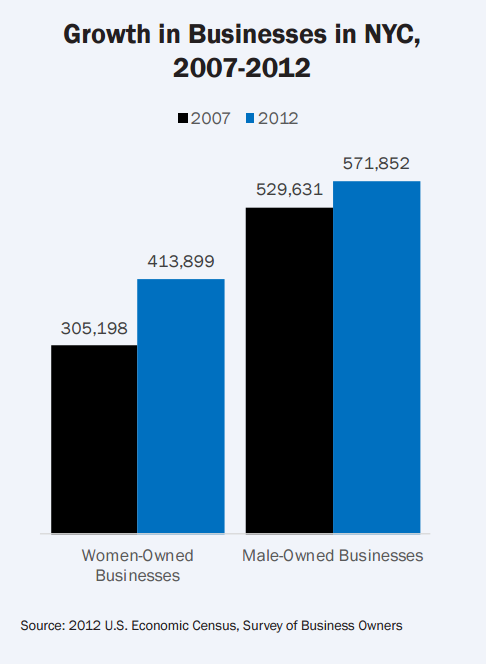

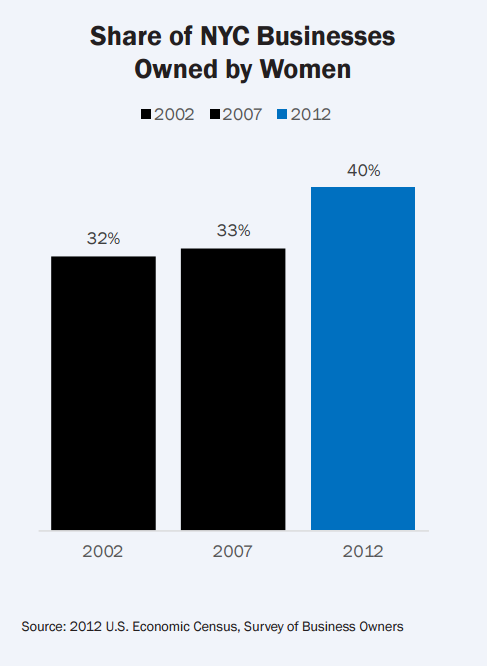

In the decade from 2002 to 2012, the most recent year for which rigorous data is available, the number of women-owned businesses grew by a whopping 65 percent or 45 new businesses every day, adding more than 56,000 jobs and $3 billion in payroll to the city’s economy. As of 2012, there were 413,899 women-owned firms in New York City, compared to 305,198 five years earlier. Today, women-owned businesses make up more than 40 percent of private companies in the city, up from 33 percent five years ago and 32 percent a decade ago.

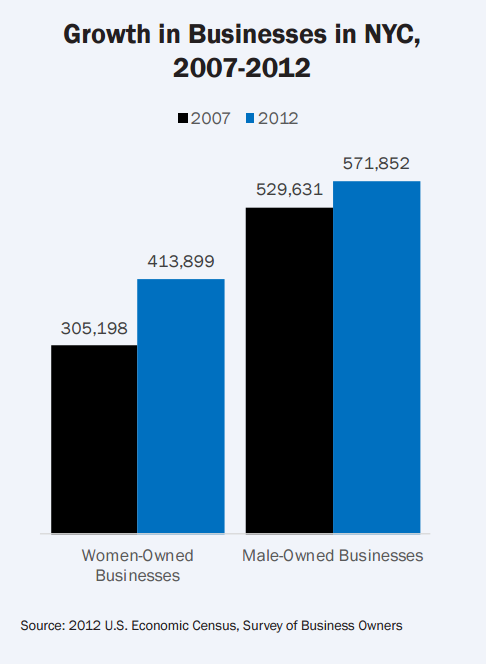

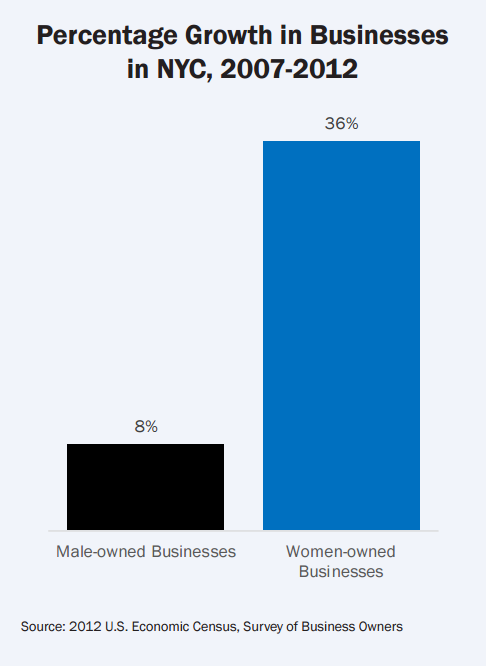

Two-thirds of the recent growth in women-owned businesses took place in the five years between 2007 and 2012, and the growth from 2002 to 2012 outpaced the 33 percent increase in businesses in the city overall as well as the 44 percent growth in the number of women-owned businesses statewide. Male-owned firms in the city grew just 8 percent between 2007 and 2012.

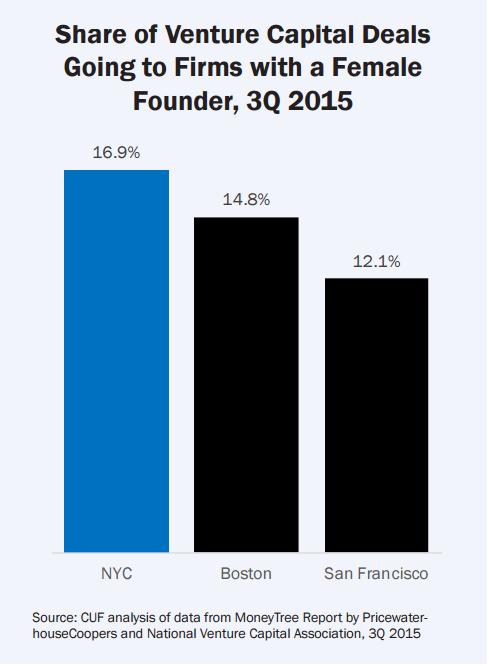

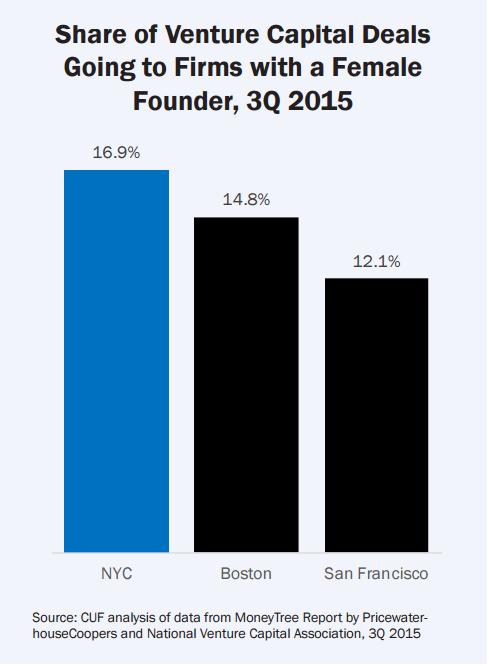

Women entrepreneurs are increasing their presence in nearly every sector of the city’s economy, with the number of women-owned businesses growing by at least 20 percent over the past five years in construction, manufacturing, health care, education, real estate, transportation and warehousing, information, retail and wholesale trade. There is also evidence that women are starting a greater share of the tech companies in New York than in Silicon Valley and Boston, the nation’s other leading tech hubs. In the third quarter of 2015, 16.9 percent of New York City companies receiving venture capital had a woman founder, compared to 14.8 percent in Boston and 12.1 percent in San Francisco.

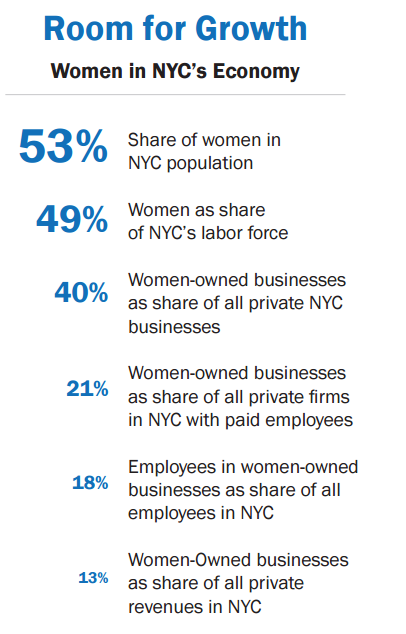

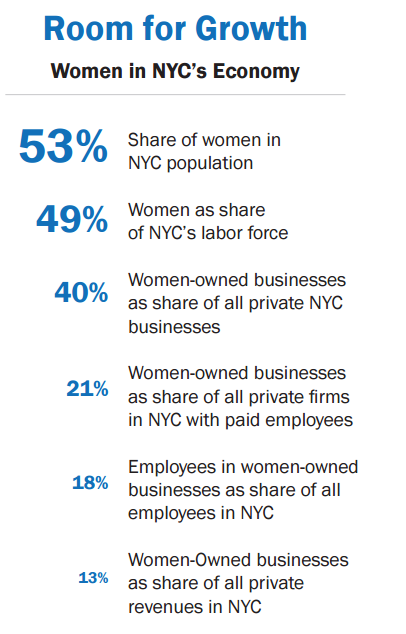

But while women-owned businesses are already making a significant contribution to the city’s economy, there is significant potential to increase the number of women entrepreneurs and to help more women-owned businesses grow to the next level. Women make up 52.5 percent of New York City’s population, according to the 2010 Census. This is a higher percentage than in all but one of the nation’s 10 largest cities, including Los Angeles, Chicago and Houston. Yet, women-run firms account for only 40 percent of privately owned businesses in the city, only 21 percent of firms with paid employees, just 17.5 percent of all private sector employees and only 13 percent of annual private business revenues. Moreover, the number of women-run firms in New York is growing at a slower rate than many other large cities.

To be sure, New York is making progress on a number of fronts to create a more supportive environment for women entrepreneurs and women who aspire to be entrepreneurs. Most notably, Mayor Bill de Blasio last year launched a promising new initiative called Women Entrepreneurs New York City (WE NYC) in an effort to expand the economic potential of women entrepreneurs across the five boroughs with a specific focus on the needs of women in underserved communities. But even more could and should be done in the months and years ahead to unlock the full potential of women entrepreneurs in New York City.

This study—the latest in a long line of Center for an Urban Future reports focusing on opportunities to grow and diversify New York City’s economy—provides a comprehensive examination of the economic importance of women entrepreneurs in New York and the role that women-owned businesses have played in the city’s recent growth. Funded by Capital One’s Future Edge Initiative, the report builds on other research about women entrepreneurs, including a 2015 report by the city’s WE NYC program. While that study focused on the economic potential of women-owned businesses in low-income and immigrant communities, this report looks at women-owned businesses in all sectors of the city’s economy, from health tech startups and digital media firms to hair braiding salons and real estate developers. It documents the size and reach of those businesses, their growth over the past decade and their economic impact compared with other businesses. It analyzes the challenges women entrepreneurs face, many of them unique to women-owned businesses, and the opportunities to expand their contribution to the city’s economy.

Based on interviews with more than 100 women entrepreneurs, investors, researchers, business consultants and heads of non-profit organizations, our report makes recommendations for steps the city, private industry and non-profit organizations can take to enable more women to start and grow businesses and add momentum and vitality to city’s economy.

What’s clear from our research is that women entrepreneurs in New York have come a long way in recent years. More than 62 percent (163,000) of the 262,000 new private companies formed in the city between 2002 and 2012 are women-owned. All told, in 2012, women-owned businesses in the city generated $53 billion in revenue, up 25 percent over 2007, employed nearly 273,000 people, 36 percent more than in 2007. Amazingly, in 2012 New York City accounted for 57 percent of all women-owned businesses in New York State, which is much higher than the city’s overall share of the state’s businesses and population.

Angel investor Joanne Wilson has witnessed those changes first hand. Six years ago, when she and NYU professor Nancy Hechinger started the annual Women Entrepreneurs Festival, the event attracted 150 attendees. Last year, 280 women attended, most of them New York City-based. This year, Wilson is expecting 400. “I’m seeing a lot more women across the board and not only young women,” says Wilson. “[They’re starting companies] from hard goods to clothing brands to cosmetics and ecommerce.”

New York City is producing some of the fastest growing women-owned businesses in the U.S. and some of the most innovative

Of the 399 New York City companies that made the 2015 Inc. 5000 list of the 5000 fastest growing private companies in the nation, 74 (or nearly 19 percent) had female founders or CEOs. That’s more than the national rate of 14 percent and exactly twice the number of fast growing women-led firms identified by Inc. in 2014, when 37 of 213 New York City companies (17.5 percent) had women founders or CEOs. Of the top 50 women-led companies on the list, seven are based in New York City, more than in any other city or area of the country.

Collectively, the revenues of the 25 largest women-owned firms in the city grew by an impressive 35 percent between 2012 and 2013, from $2.2 billion to $3.4 billion, according to Crain’s New York Business.

Female founders are also innovators in some of the most cutting edge technologies. There’s Daniela Perdomo, whose Brooklyn-based GoTenna developed a hardware device that lets smartphone users talk to each other even in places without cellular coverage or WiFi, and Limor Fried, an MIT engineering grad who founded Soho-based Ada Fruit, which designs and builds do-it-yourself electronics kits and reportedly generated $33 million in sales in 2014.1 There’s also Ayah Bdeir, whose company littleBits makes electronic building blocks that empower kids and adults to create their own inventions.

“What I’ve seen from female founders in New York City over the past 10 years is truly revolutionary,” says Jalak Jobanputra, founder of the New York City-based early stage venture fund Future\Perfect Ventures. “From food entrepreneurs to those creating new business models in the commerce, finance and mobile sectors, women are stepping up, taking risks and working toward a better future for all of us.”

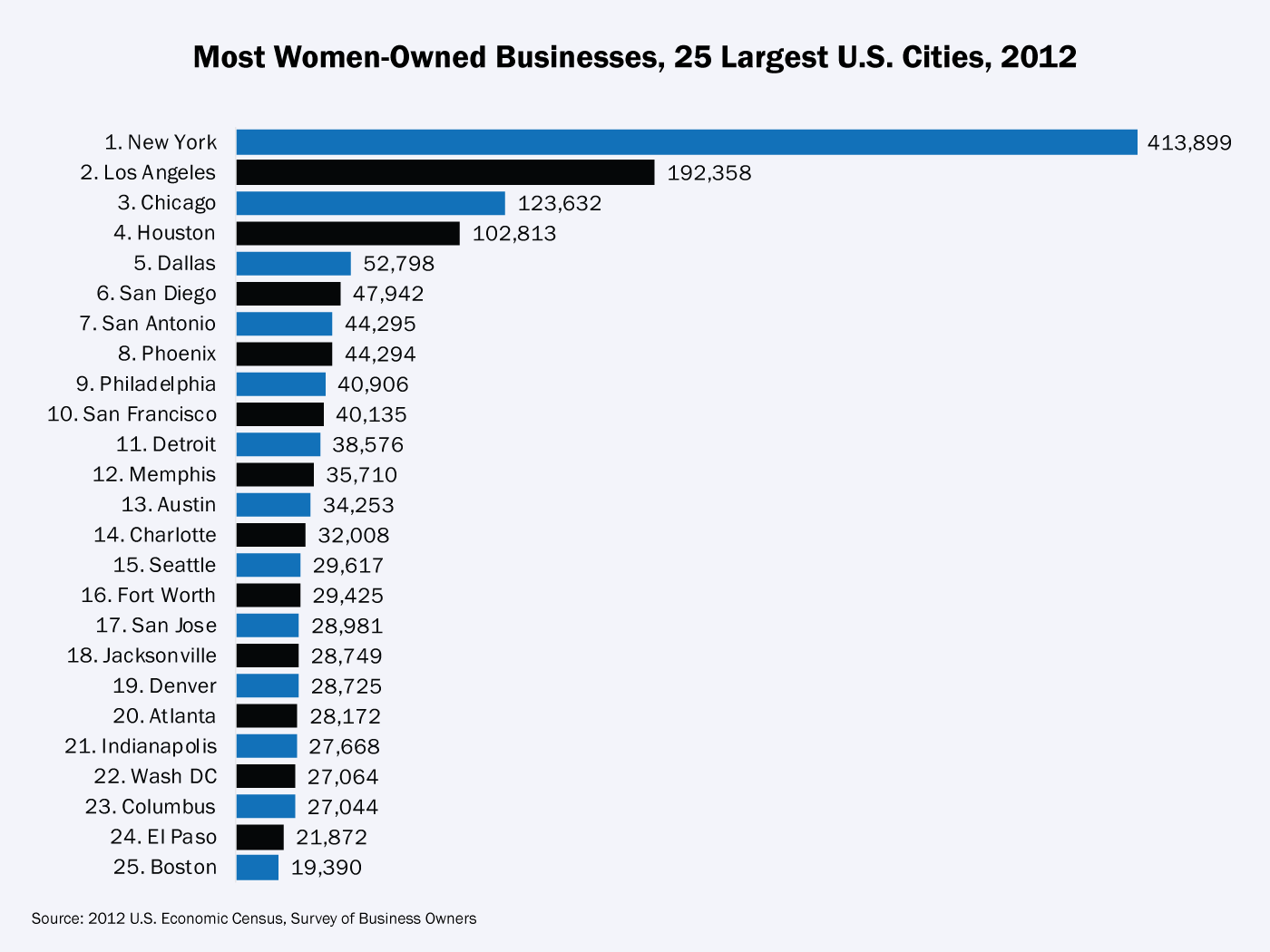

When compared with other major cities around the country, New York has more women- owned businesses by far: 413,899, and more than double the next nearest competitor, Los Angeles (192,358). Yet, the ranks of women entrepreneurs here are growing more slowly and they are delivering less economic impact than sister businesses in other cities. According to the 2012 U.S. Census, New York City ranks 19th among the 25 most populous cities in the growth of women-owned firms between 2007 and 2012, 18th in average sales and seventh in the average number of people they employ. The average women-owned business in New York City has sales of $128,268, much lower than female-owned firms in Dallas ($198,599), Houston ($181,122), San Francisco ($175,766), Boston ($169,020), Seattle ($162,948), Washington, DC ($162,495), Los Angeles ($142,378) and several other large cities.

Female founders are starting and building companies in every industry in the city, including traditionally male dominated sectors

Entrepreneurs typically start companies in industries in which they have experience and expertise. So it’s not surprising that women entrepreneurs are most visible in industries where women make up a significant share of the workforce. For instance, women own the vast majority of the city’s day care businesses and nail salons, sectors in which women currently account for 90 percent and 80 percent of the workforce, respectively. Women also own 70 percent of the enterprises in the city’s health care and social assistance sector (where they comprise 77 percent of the workforce) and 60 percent of all businesses in the educational services industry (where they account for 68 percent of all workers).

Similarly, female entrepreneurs in the city are especially active in fields such as fashion, beauty, design, education and food. According to a CUF analysis, startups with a female founder account for nine of the ten companies in the CFDA (Council of Fashion Designers of America) Incubator, 106 of the 130 companies (82 percent) that have participated in the city’s Design Entrepreneurs NYC Accelerator, and 103 of the 135 companies that have worked out of The Entrepreneur Space, a Long Island City-based kitchen incubator.2

On the flip side, women entrepreneurs have been less prevalent in fields where women make up a smaller share of the workforce. Businesses owned by women comprise just 15 percent of all private companies in the city’s construction industry and 22 percent of firms in wholesale trade, fields where women currently make up 7 percent and 36 percent of the workforce, respectively. The city’s tech sector has also historically had a fairly small share of women founders. The disparity is partially explained by the fact that women comprise just 28 percent of those working in computer systems design, the largest of the industries that make up New York’s tech sector, and 33 percent of the workforce in the software publishing field.

But even in sectors where they remain a minority, the number of women-owned firms is growing rapidly. Women-owned construction and construction-related businesses increased by more than a third—some 2,600 firms—between 2007 and 2012. That includes an 80 percent jump in Queens alone.3 During the same period, the number of construction related firms owned by men grew a mere 2.3 percent. In transportation and warehousing—which includes taxi, bus and limousine services among other types of businesses—women entrepreneurs own just 8 percent of firms, but their numbers grew by 50 percent during those five years. In finance and insurance, they own 26 percent of private firms, up 9 percent since 2007.

Over the past five years, the number of firms increased by at least 20 percent in nearly every major industry sector, including: manufacturing (23 percent), wholesale trade (20 percent), real estate (20 percent), information (21 percent), professional, scientific, and technical services (38 percent), educational services (46 percent), arts, entertainment and recreation (23 percent), retail trade (26 percent), accommodation and food services (45 percent), health care and social assistance (26 percent).

Women founders are making gains in the city’s tech sector, and could help give New York a competitive advantage over other leading tech hubs

In tech, the number of women-founded startups has exploded in recent years. A 2014 study by Endeavor Insight found that the number of New York City tech companies with female founders has grown tenfold since 2003.4 And a CUF analysis shows that in 2015, six of the eight companies that received funding from New York Angels, one of the city’s leading angel investment groups, had a woman founder. In contrast, between 2003 and 2009, none of the 11 companies receiving funding from New York Angels had a female founder.

Meanwhile, a growing number of women tech entrepreneurs in the city are raising later stage capital or achieving a successful exit, key barometers of success in the sector. In 2015, LearnVest, the personal finance startup founded by Alexa von Tobel, was acquired by Northwestern Mutual for $250 million, one of largest venture-backed exits in the city last year. In the past few months alone, Digital Asset Holdings, the blockchain or tamper-resistant database startup run by Blythe Masters, raised $52 million in Series A financing; ClassPass, the fitness startup founded by founded by Payal Kadakia and Mary Biggins, raised $30 million in Series C financing; Bauble Bar, the fashion jewelry e-commerce company started by Amy Jain and Daniella Yacobovsky, raised $20 million in Series C financing, and PolicyGenius, the insurance startup co-founded by Jennifer Fitzgerald, raised $15 million in Series B financing.

Perhaps more importantly, New York may be better positioned than other leading tech hubs to attract women founders. Several of the women tech entrepreneurs we interviewed say that New York is ahead of Silicon Valley in the overall number of women tech founders and in having a supportive ecosystem for women entrepreneurs. “In my experience, New York has been a much more welcoming and hospitable environment than the Bay Area,” says Kathryn Minshew, co-founder of The Muse, an online career advice company that now boasts 75 full-time employees.

After starting her company in New York in the fall of 2011, Minshew moved the company to the Bay Area when an investor urged her to do so. But after spending eight months on the West Coast, The Muse moved back to New York in the fall of 2012. “I felt New York had more of a community of women entrepreneurs helping each other, and more industry diversity, including areas where women held positions of power, like media and fashion. It’s a more support ecosystem for women entrepreneurs whereas the tech community in the Bay Area feels more homogenous.”

Women-owned firms are growing in all boroughs and among all racial and ethnic groups

Every borough experienced a significant increase in the number of women-owned businesses in the half-decade between 2007 and 2012, with the Bronx topping the list with a 53 percent increase. Queens had the second highest growth rate (40 percent), followed by Brooklyn (39 percent), Staten Island (27 percent) and Manhattan (22 percent). In some boroughs, women-owned businesses have grown faster than male- owned businesses and businesses in the borough as a whole.

In 2012, Brooklyn surpassed Manhattan as the borough with the most women-owned businesses in the city. Brooklyn was home to 118,489 women-owned firms, compared to 114,896 in Manhattan, 97,982 in Queens, 68,705 in the Bronx and 13,921 in Staten Island. But Brooklyn is third among all boroughs when it comes to total employment at women-owned businesses. While Brooklyn’s female-owned firms have 51,361 employees, that is considerably less than both Manhattan (124,952) and Queens (75,351). And though Manhattan accounted for 28 percent of all women-owned firms in the five boroughs in 2012, it made up 44 percent of women-owned businesses that have paid employees and 59 percent of total revenues at women-owned firms in the city.

While the 2012 U.S. Census Survey of Business Owners does not break down women-owned businesses into racial and ethnic categories at the city or county level, a CUF analysis of women entrepreneurs in New York State shows that businesses owned by African-American, Asian and Latino women all grew at a rapid pace between 2007 and 2012.

In fact, those 5 years of growth saw the number of women-owned minority firms grow by 58 percent. At the state level, African-American women entrepreneurs added nearly 26,000 businesses, a 26 percent increase, and almost $300 million in sales totaling $3.3 billion in 2012. Firms owned by Asian women grew 52 percent, added nearly 53,000 employees and generated $10.8 billion in sales. Similarly, Latina owned businesses grew by 68 percent over the five-year period, adding some 8,000 jobs and generating $4.8 billion in revenue.

In our interviews across the five boroughs, it was apparent that the city’s growing immigrant community is spawning thousands of businesses, with women starting companies out of their kitchens and living rooms often to provide or supplement family income or as alternatives to low-wage jobs. In some of those communities, their growth is outpacing that of male-owned businesses.

Accion, a microfinance organization that provides business loans and technical assistance to small-scale entrepreneurs, has nearly doubled its loans in New York City since 2011, with 40 percent of them going to women entrepreneurs. At the New York City-based Business Center for New Americans in Manhattan, a microfinance organization that helps immigrants and refugees achieve self-sufficiency, 90 percent of participants in its workshops and training programs are women. This year, the organization will make 300 loans to entrepreneurs, nearly half of them women.

At the Business Outreach Center Network (BOC), another microfinance organization with several locations across the city, 683 women clients received one-on-one business counseling in 2015, and 73 percent of the clients seeking one-on-one business counseling are women. And at the LaGuardia Community College’s Small Business Development Center, nearly half of the 800 to 900 would-be business owners who train there every year are women. Similarly, at the Women’s Business Center of the Queens Economic Development Corporation, about 600 would-be entrepreneurs sought advice and support in 2013 and 2014.

Perhaps the most dramatic growth is happening at micro-lender Grameen America, which lends only to women entrepreneurs living at or below the poverty line. As of January 2016, Grameen has provided loans, technical support and networking to more than 36,000 low-income and immigrant women in New York City. “Partnering with Grameen America to empower women entrepreneurs and support and fuel these ecosystems has been incredibly rewarding and eye-opening,” said Keri Gohman, head of Small Business Banking at Capital One. “It’s encouraging to see the impact these programs are having on women, their businesses and their communities at large.” Since its start in New York City in 2008, Grameen has made more than 110,000 loans here totaling $261 million, the majority to women starting and operating businesses not in the trendy tech sector, but in the kind of everyday industries that give life and stability to communities—beauty shops, clothing stores and food and beverage establishments. Indeed, women entrepreneurs in New York account for 58 percent of all the women in the United States served by Grameen. “It’s the New York spirit,” says Grameen America CEO Andrea Jung. “They want to be productive entrepreneurs and contribute to the economy of the city.”

Too few women-owned firms in New York scale up their businesses

While women entrepreneurs are reinventing some industries and changing the make-up of others, women-owned businesses in New York City tend to stay small whether they want to or not. Of the 150 largest private companies in the city, just 17 are headed by or were founded by a woman.5 In 2015, companies with a woman founder accounted for just five of the 50 companies on the Crain’s New York Business Fast 50 ranking of the city’s fastest growing businesses. Even in the tech community, few female-founded startups have “exited” through an IPO or acquisition.

Like most businesses, women-owned firms start small, often employing just the owner. But they also tend to stay small, their growth stymied by lack of capital and training and limited access to networks and connections needed to get to the next level. Indeed, the overwhelming majority of women-owned businesses in the city are “solopreneurs,” businesses that employ only the owner. Those businesses without employees are the fastest growing segment of women-owned firms in the city. Their numbers increased 69 percent between 2002 and 2012 and today make up 91 percent of all businesses in the city that are owned by women, some 376,000 businesses versus only 37,494 women-owned businesses with at least one paid employee in addition to the owner.

If only one quarter of the existing 376,405 women-owned businesses in New York City with no employees added a single employee in the next three years, it would result in more than 94,000 new jobs.

Most businesses owned by men, 78 percent, also are solopreneur ventures. But the average annual sales of women-owned solopreneur businesses, $29,000, are barely more than half the average annual sales of male-owned non-employer businesses, $54,000. That’s true as well for businesses that have employees, where annual revenues of male owned firms are more than twice that of female owned companies, $2.3 million versus $1.1 million.

Those differences exist citywide. In Manhattan, women-owned businesses generated $272,000 in annual sales, on average, versus $1.1 million for firms owned by men. In Brooklyn, women entrepreneurs averaged $80,000 in annual sales, just 26 percent of the $303,000 their male counterparts generate.

Women entrepreneurs face a number of challenges

One reason for the disparity between companies owned by men and women is that half of women-owned businesses in New York City are in low-revenue industries, such as health care and social services, educational services, the arts and personal care businesses. Many are also home-based, which allows women to accommodate their other obligations but also sharply limits their growth potential.

However, as this report documents, women entrepreneurs face a number of significant challenges when trying to start or grow businesses in New York. They encounter the same difficulties as other entrepreneurs—including the city’s high rents, taxes and labor costs, and the intense competition that business owners here face—but also face a number of unique barriers.

Perhaps most importantly, several studies have shown that women have less money to invest than men. While virtually every small business owner struggles to access capital, many of the experts we interviewed say that women typically face greater challenges, in part because women generally own smaller businesses and thus seek smaller amounts of credit, a problem since traditional lenders are more apt to make larger loans.

As one indication of this, in fiscal 2014, women business owners in the New York metro area received 386 SBA (U.S. Small Business Administration) loans totaling $97.6 million, about 20 percent of all loans made in the region that year and 12 percent of the total dollars lent.

Even in the tech sector, where it has become cheaper and easier to start a company, women entrepreneurs attract less money. Our analysis of the MoneyTree report, a quarterly study of the nation’s venture capital deals published by PricewaterhouseCoopers and the National Venture Capital Association, reveals that while 16.9 percent of New York City companies receiving VC funds in the third quarter of 2015 had a female founder, companies with a female founder accounted for just 8.7 percent of the total VC funds received that quarter—$122 million out of $1.41 billion. That’s a smaller percentage than San Francisco, where women founded companies accounted for 9.0 percent of total VC funds raised in that quarter ($293.5 million out of $3.27 billion) and Boston, where women-founded companies accounted for 21.8 percent of all VC funds raised in the quarter ($138.4 million out of $634.5 million).

It doesn’t help either that at the top 20 most active venture capital firms in the city, just seven percent of the investment teams are women, a ratio that many believe has contributed to lower financing rates for women tech founders.

Access to capital is hardly the only challenge facing the city’s women entrepreneurs. Many of the women we interviewed for this report say that a lack of connections can be equally problematic and our research suggests that it’s often more difficult for women to navigate traditional business networks.

Another challenge is that many aspiring women entrepreneurs, especially low-income and immigrant women, lack basic business and financial skills. Many women say they don’t know where to go for training and advice. While there is a growing cadre of organizations and industry associations mounting programs and allocating capital for women-owned businesses, there are many more women than slots available.

We also found that women often have to work harder to be taken seriously and fight perceptions that female founders are less capable and less committed than their male counterparts. At the same time, several of the entrepreneurs and business experts we interviewed said that women sometimes have to overcome internal challenges, including a lack of confidence and a smaller appetite for risk.

Whether it has a cultural, educational or personal source, the lack of confidence can show up in different ways. At New York Tech Meetup, for example, Executive Director Jessica Lawrence has at times had to beg and cajole female founders to present their companies at the organization’s demo nights. Women entrepreneurs, she says, claim they’re not ready to go public or their product is not ready or they’re “not tech enough.” Only when she, reluctantly, organized an all-women demo night, did she get significant numbers of women entrepreneurs willing to go on stage.

“If I tell a woman I don’t have a demo slot, she’s more likely to disappear and never come back,” says Lawrence. “Men are much more aggressive. One guy sent me a different email every day for 28 days straight with a new reason every day for why he should get to do a demo. I don’t see women doing that.”

Finally, too few women entrepreneurs are applying for and winning city government contracts, a problem since doing business with government can catapult small businesses to new heights. Mayor de Blasio has admirably taken new steps to increase the number of women and minority businesses who receive city contracts, but much work remains. In fiscal year 2015, just 1.5 percent of total city spending went to women-owned businesses. And relatively few women are even certified as Women Business Enterprises (WBEs), a designation needed to apply for the city’s Minority and Women Business Enterprise (M/WBE) contracting program. As of January 2016, 1,481 businesses were certified WBEs, including 710 in Manhattan, 309 in Brooklyn, 259 in Queens, 125 in the Bronx and 78 in Staten Island.

Harnessing the potential of women entrepreneurs in New York City

Despite these and many other challenges, women are contributing enormously to New York City’s economy. At the same time, however, the city has only begun to harness the tremendous potential of women entrepreneurs.

Unleashing the full potential of women entrepreneurs in New York would have a far-reaching impact on the city’s economy. For instance, if only one quarter of the existing 376,405 women-owned businesses in the city with no employees added a single employee in the next three years, it would result in more than 94,000 new jobs.

In a city where women make up 52 percent of the population, there is undoubtedly an opportunity to increase the number of women entrepreneurs, particularly in low-income communities. But an equally important task will be to help more of the city’s women-owned businesses scale up and grow. This means ensuring that more of the women who operate home-based businesses expand into a storefront or office, that more of the small-scale food manufactures export their products beyond New York and that more startup tech firms gain access to venture capital and realize their potential for growth.

The good news is that, especially in today’s entrepreneurial economy, the opportunity to do all this is unlimited. “I think we focus a little too much on the inequity of it all, and not enough on the investment opportunity,” says Susan Lyne, founder and managing partner of BBG (Built by Girls) Ventures, which invests in early stage women-led startups. “Women are the dominant users of the fastest growing social platforms, we spend more time and do more with our mobile phones, and we make or influence 85 percent of consumer purchases. It’s smart business—not to mention common sense—to back entrepreneurs who know that end user best.”